In July, China launched the world’s largest green hydrogen plant. One month later, India’s government backed 19 projects designed to make the country a leader in producing green hydrogen, which could help decarbonize everything from steel to shipping. Saudi Arabia and the United Arab Emirates are pumping billions of dollars into infrastructure to produce and export the fuel over the next few years.

The United States, meanwhile, is yanking funding for some of its most ambitious clean-hydrogen projects.

Last week, as part of a list of 321 grants revoked in the name of saving $7.5 billion in spending, the Department of Energy rescinded $2.2 billion in awards to two of the seven hydrogen regional hubs established under the bipartisan Infrastructure Investment and Jobs Act. Unlike the five other hubs, the law designed the terminated projects, in California and the Pacific Northwest, to focus exclusively on hydrogen made with renewable electricity, making them an easy target as the Trump administration slashes Biden-era clean energy projects.

Now this week a second Energy Department list shared with Canary Media indicates the agency is considering whether to pull funding from all seven hydrogen hubs, including those in Texas, Appalachia, and the mid-Atlantic and two in the Midwest.

It’s not certain whether the entire $24 billion worth of awards on the new list will be eliminated. Companies whose projects appeared only on the second list, including utilities and carbon removal firms, have yet to receive notice of cancellation. While federal officials gave companies involved in the West Coast hubs a warning before announcing the cuts last week, three separate producers involved in the other five hubs had not heard from the administration as of Thursday, according to California Hydrogen Business Council CEO Katrina Fritz, who checked in with the sources.

But already, the potential cuts are sowing doubt within the emerging sector — and in the clean energy space more broadly.

“Any amount of uncertainty in funding is really detrimental to private-sector investment, and that’s just not a good way to spur innovation domestically and compete on a global stage,” said Rachel Starr, the senior U.S. policy manager for the hydrogen program at the Clean Air Task Force. “Plenty of other countries are investing in this. We’re going to lose our competitive edge if we stop.”

“Yeah, I’m worried”

It remains unclear whether the document outlining a fuller list of cuts, which a lobbyist told E&E News was weeks old, represents an expansion of the previous cuts or a maximalist proposal from which the earlier terminations were whittled down.

In a statement, the Energy Department said it was “unable to verify” the list but that the agency “continues to conduct an individualized and thorough review of financial awards made by the previous administration.”

A former Energy Department official with direct knowledge confirmed that the list is legitimate and said that it represents the grants DOE officials have recommended for cancellation to the White House. The official suggested that the agency is obfuscating its plans to pull the grants to regional hubs in red states until after a federal budget is passed, an effort to prevent congressional Republicans from adding an amendment that preserves the funding into the budget.

“They can’t do that in the middle of a government shutdown,” the official, who spoke on condition of anonymity, told Canary Media. “I do expect them to cancel these funds … [but] not until there’s a full-year appropriations [bill].”

Already, key Republican lawmakers have expressed concern.

“Yeah, I’m worried,” Senate Environment and Public Works Committee Chair Shelley Moore Capito told E&E News when asked about the possibility of losing funding for West Virginia’s hydrogen hub. “It’s a big deal for us.”

The uncertainty only adds to the challenges facing the hydrogen industry.

The Biden administration created a two-pronged hydrogen strategy via the bipartisan infrastructure law and the Inflation Reduction Act. The IRA’s tax credit for clean hydrogen production, known as 45V, was meant to help spur supply of the fuel. The policy survived the rollbacks in the One Big Beautiful Bill Act that Trump signed in July, but Republicans shortened the timeline for the write-offs from 10 years to two.

The hydrogen hubs, meanwhile, were meant to coordinate producers and offtakers to create regional ecosystems that could someday be interconnected with pipelines and other infrastructure. Even before the cuts, however, the hubs were struggling to generate enough demand.

“Low demand explains why the West Coast hydrogen ambitions have never amounted to much,” Martin Tengler, the analyst who heads the hydrogen research team at the consultancy BloombergNEF, wrote in a memo to investors Monday. “Low demand stems from a lack of incentives such as the quotas or carbon prices that are present in Europe, combined with a focus on sectors where hydrogen use is highly uneconomical.”

As a result, he argued, the decision to slash funding for those two hubs “has little direct impact on the pipeline of projects BloombergNEF has expected to come online by 2030.”

Of the six commercial green hydrogen projects larger than 1 megawatt that the consultancy tracked in its latest outlook report, four have reached a final investment decision and just one is operational. “All five are very small,” the investor note stated.

In an email to Canary Media, Tengler said the impact of eliminating funding for all the hubs “would be negative, but the most important things are the tax credits.”

Back to the States

The hubs won’t necessarily fall apart without the federal grants.

California’s regional hub, known as the Alliance for Renewable Clean Hydrogen Energy Systems, or ARCHES, plans to continue without the financing and could turn to state funds to make up the difference. The Golden State’s newly overhauled cap-and-invest program is one potential source. The state Clean Truck and Bus Vouchers program, known as HVIP, and the California Energy Commission’s Clean Transportation Program Investment Plans could bolster offtakers.

“California has been a hydrogen hub for many years, and it’s getting bigger and bigger,” Fritz said. “It’s already in application. There are people riding on hydrogen fuel-cell buses every day in California.”

Roxana Bekemohammadi, executive director of the U.S. Hydrogen Alliance, said it’s possible that Congress could extend the 45V tax credit before it expires at the end of 2027. But in the meantime, she said, “state-level hydrogen incentives are the most stable path forward.”

Whether states can deliver a green hydrogen industry at scale, however, remains to be seen — and removing billions in federal funding certainly doesn’t make the task easier.

“The cuts to these hubs seem shortsighted and ultimately will result in the loss of jobs in our country,” said Carrie Schoeneberger, an industrial analyst who covers hydrogen for the Natural Resources Defense Council. “This will put the U.S. a step back and threaten U.S. leadership, which is against the stated aims of the current administration for American energy dominance.

Jeff St. John contributed reporting.

The first wind farm slated to plug into New York City’s grid has already endured one political catastrophe this year. Now, a logistical crisis looms on the horizon.

Equinor’s Empire Wind is a 810-megawatt project being built about 20 miles off the shore of Long Island, promising enough energy to power 500,000 homes once completed in 2027. The Trump administration halted construction in April, but allowed it to resume in May. The latest challenge came on Thursday with the unexpected cancellation of a contract for the massive new wind-turbine installation vessel that Equinor had been planning to use on the project next year.

Two shipbuilding companies broke out into a public skirmish — one unexpectedly cancelling a contract and the other threatening legal action — over the construction of the specialized ship. The fate of the vessel, which is already more than 98% complete and floating in Singapore’s waters, is now uncertain.

The cancelled $475 million agreement leaves Equinor scrambling to figure out how to maintain progress and bring Empire Wind online on schedule.

“We have been informed by Maersk of an issue concerning its contract with Seatrium related to the wind turbine installation vessel originally contracted by Empire Offshore Wind LLC for use in 2026,” said an Equinor spokesperson via email. “We are currently assessing the implications of this issue and evaluating available options.”

Only a handful of vessels in the world are capable of lifting, carrying, and piecing together the massive steel components of offshore turbines.

Thursday’s news highlights the complexity of bringing just one U.S. offshore wind farm over the finish line, given the combination of logistical difficulties and political obstacles put up by the Trump administration.

In an email to Canary Media, a Maersk Offshore Wind spokesperson confirmed that the company terminated its building contract with Seatrium “due to delays and related construction issues.” The spokesperson declined to comment further.

Seatrium told Reuters it was evaluating its options for the vessel, including via ongoing talks with Empire Wind, and considering legal action.

Singapore-based Seatrium is fresh off the monumental achievement of berthing a first-of-its-kind offshore-wind installation vessel in U.S. waters. In September, the company delivered the $715 million Charybdis from its Brownsville, Texas, shipyard to the Portsmouth Marine Terminal in Virginia. The American-made vessel is owned by utility Dominion Energy, which immediately put it to work building the largest offshore wind farm in the U.S. The ship’s smooth delivery is a major reason why the Coastal Virginia Offshore Wind farm is progressing fast enough to have a new March 2026 launch date.

The ship’s hull is 472 feet long and 184 feet wide, making it one of the biggest vessels of its kind in the world. And, more importantly, it was built to serve the entire U.S. sector — not just Dominion Energy’s project. In other words, the Charybdis could be a solution to Equinor’s new problem.

“Upon the completion of its charter with [Coastal Virginia Offshore Wind], the versatile Charybdis will be available to support a variety of projects, including offshore wind and other critical heavy lift shoreline projects, such as salvage operations or other energy projects,” said Jeremy Slayton, a Dominion Energy representative, in an email to Canary Media.

An Equinor spokesperson provided no comment about Charybdis but reiterated that the company is exploring all options. Having survived the recent political storm, the company is well positioned to navigate these latest headwinds.

About 30 miles off the coast of Virginia Beach, Virginia, workers have been building America’s largest offshore wind farm at a breakneck pace. The project will start feeding power to the grid by March — the most definitive start date provided by its developer yet.

“First power will occur in Q1 of next year,” Dominion Energy spokesperson Jeremy Slayton told Canary Media. “And we are still on schedule to complete by late 2026.”

In an August earnings call, Dominion Energy CEO Robert Blue provided a vague window of “early 2026” when asked when the 2.6-gigawatt Coastal Virginia Offshore Wind (CVOW) project would start generating renewable power for the energy-hungry state.

As of the end of September, Dominion had installed all 176 turbine foundations — “a big, important milestone,” per Slayton. That accomplishment involved pile-driving 98 foundations into the soft seabed during the five-month stretch when such work is permitted. Good weather helped the work move along quickly, as did the Atlantic Ocean’s unusually quiet hurricane season.

Speed is key when building wind projects under the eye of a president who has called turbines “ugly” and “terrible for tourism” — and who has followed up with attempts to dismantle the industry.

Had CVOW not finished foundation installation by the end of this month, turbine construction would have been delayed until next spring. Federal permitting restricts pile-driving to a May-through-October window to protect migrating North Atlantic right whales. Such a delay would have made CVOW more vulnerable to the wrath of the Trump administration, which has already issued stop-work orders to two offshore wind farms under construction.

But Slayton said the threat of President Donald Trump’s interference doesn’t concern him. CVOW is, after all, one of only two in-progress offshore wind projects that hasn’t been directly attacked by the president.

“Our project has enjoyed bipartisan support from the beginning,” he said, pointing to backing from some of the state’s leading Republicans, including Gov. Glenn Youngkin and U.S. Rep. Jen Kiggans.

Kiggans, who represents the politically moderate Virginia Beach area, brought her concerns about Trump’s escalating war on wind to the House floor last month, when Congress returned from recess. She called CVOW “important to Virginia,” and House Speaker Mike Johnson (R-Louisiana) later told reporters that he relayed Kiggans’ message directly to Trump.

“I understand the priority for Virginians and we want to do right by them, so we’ll see,” Johnson told Politico’s E&E News, in a comment that broke from an anti–offshore wind narrative that’s taken root among many of his fellow House Republicans.

The project is crucial for helping the state meet a deluge of new electricity demand, as Virginia is at the center of the nationwide boom in data-center construction. CVOW will provide a huge amount of carbon-free power to the state and Dominion, its largest utility — helping both keep pace with rising demand without having to burn more polluting fossil fuels.

Kiggans also tied the success of CVOW to the needs of Virginia’s military installations.

“I always speak about that project in light of the national security benefit and that benefit to Naval Air Station Oceana,” Kiggans said last month in an interview with WAVY, a Virginia news station, noting that a partnership with Dominion is “giving Naval Air Station Oceana a $500 million power grid upgrade.”

Dominion has already spent $6 billion on the monumental effort to build CVOW, which has been 12 years in the making. Almost $1 billion of that investment has flowed to the local economy, creating 802 full- and part-time jobs in the state’s Hampton Roads region, according to G.T. Hollett, Dominion Energy’s director of offshore wind.

CVOW’s benefits are being felt nationwide too.

“The project has already created 2,000 direct and indirect American jobs and generated $2 billion in economic activity, strengthening the nation’s manufacturing supply chains and our regional economy,” said Katharine Kollins, president of Southeastern Wind Coalition.

Now Dominion will turn to the final phase of construction: turbine installation. The work is made possible by Charybdis — the first U.S.-built, Jones Act–compliant wind-turbine installation vessel — which arrived in Virginia’s Portsmouth Marine Terminal last month.

“When Charybdis is loaded up, it will have all the components to install four turbines with each trip,” said Slayton, who noted that the pace of the build is well timed given Virginia’s data-center boom. The state is facing “record growth and energy demand … maybe you’ve heard.”

Power demand from data centers threatens to scuttle utility decarbonization goals, push grid infrastructure to the brink, and drive up electricity costs for everyday customers already struggling to pay their bills.

But a new report identifies a strategy that utility planners can take to avoid these problems while still providing data centers with the massive amounts of power they require. They simply need to convince data centers to use less electricity from time to time — and they need to do so early in the utility planning process, when it’s still a win-win for both developers and utilities.

The report, based on research conducted by analysis firms GridLab and Telos Energy, used NV Energy, Nevada’s biggest utility, as a case study. According to its numbers, NV Energy could save hundreds of millions of dollars and defer hundreds of megawatts of “new firm capacity needs” — i.e., fossil-gas-fired power plants — if the proposed new data centers in its territory agree to be flexible.

But all these benefits are predicated on that flexibility being “factored into resource planning early on rather than being an afterthought,” Priya Sreedharan, a senior program director at GridLab, said during a webinar last week. Without that vital early work, utilities will lock in multibillion-dollar investments to manage the grid peaks that they assume inflexible data centers will cause.

And once those plans are in motion, the chief incentive for data-center developers to commit to being flexible with their energy — getting faster grid interconnections — will evaporate.

Grid planners and utilities face an unprecedented wave of power demand as tech giants race to build data centers to support their artificial-intelligence ambitions. In many cases, plans for new data centers — the largest of which can use as much power as a small city — are spurring the construction of new fossil-fueled power plants, putting decarbonization further out of reach and raising costs for consumers.

The GridLab–Telos Energy report adds to a growing body of work identifying flexibility as a way for data centers to connect to the grid quickly without causing utility costs and emissions to skyrocket.

To become flexible, data centers will need to invest in gas-fired generators, batteries, solar panels, or other resources to supply their own power needs during times of peak demand. Or they’ll need to take on the technically complex task of ramping down power-hungry computing processes when the grid is under the greatest stress.

Data centers won’t do that just to save money on their electric bills, said Derek Stenclik, founding partner at Telos Energy. But they might do it to speed up when they get connected to the grid — or, in data-center parlance, “time to power.”

In some parts of the country, data centers are struggling to get the grid connections they need even though they’re willing to pay extremely high power prices to secure them. That’s because building the power plants and grid infrastructure to meet their demands can take years.

“If you go to a prospective data center and say, ‘Hey, with our queue, it’s going to take five years for us to bring on new resources to build the transmission to get to you and you can wait five years, or we can interconnect you in two years if you’re willing to curtail 10 to 12 hours a year,’ the answer there will be much, much different than if you’re asking them after they’ve been designed,” Stenclik said.

GridLab and Telos Energy chose NV Energy as a test case for a few reasons.

First, the utility has a ton of new data centers trying to connect to its grid — enough to add 2 gigawatts of peak load by 2030 — and keeping up with that demand will be expensive. Former NV Energy CEO Doug Cannon told the Nevada Appeal in February that the utility may need “billions of dollars of investment” to “double, triple, even quadruple the size of the total electric grid” in the northern Nevada region where most of the new data centers are being built.

Second, GridLab and Telos were ready to model the impact of flexible data centers in the region because they served as experts for groups intervening in the utility’s 2024 integrated resource plan. Utilities, regulators, and other stakeholders use these plans to figure out what mix of generation resources are required to meet future grid needs.

NV Energy’s latest plan calls for converting a coal-fired power plant in northern Nevada to run on fossil gas, rather than building solar and batteries at the site, as it had previously proposed — a decision opponents are formally challenging because they argue it will increase customer costs. Like many U.S. utilities, NV Energy faces backlash over rising rates, including an overcharging scandal that coincided with Cannon’s resignation in May.

Similar load-growth pressures driven by the AI data-center boom are pushing utilities across the country to plan far more new gas-fired power plants, at great cost not only to the climate but also to customers, who will pay higher bills to cover the cost of building and fueling them. Data centers are already pushing up electricity rates in some parts of the country.

Flexible data centers could make a big dent in these costs by allowing utilities to rely more on solar and batteries, which are less costly and faster to build than gas plants. GridLab and Telos Energy’s fact sheet on their analysis of NV Energy found that “even modest levels of load flexibility can yield large capacity savings.”

Specifically, the report found that 1 GW of data-center flexibility could defer from 665 to 865 megawatts of new firm capacity needs and save $300 million to $400 million through 2050. Those savings would come from alleviating the utility’s need to build more gas-fired power plants and from substituting more “lower cost ‘energy’ focused resources such as solar plus storage.”

Getting data centers to commit to energy-flexible operations could make a huge difference across the country, according to Tyler Norris, a Duke University doctoral fellow who is a former solar developer and special adviser at the Department of Energy. He co-authored an analysis released in February that found nearly 100 gigawatts of existing capacity on U.S. grids for data centers that can commit to a certain level of flexibility.

Getting data centers to ease off during specific hours of the year is eminently feasible, Norris argued in an August presentation to state utility regulators. Data centers’ “capacity utilization” rates — a measure of how much of their total potential power demand they’re using across all hours of the year — are all over the map, with some analyses estimating rates as low as 50%.

But utility planners can’t build a grid around estimates, and data-center developers don’t have good reasons to commit to using less power unless they see a clear reward.

“Not even the most sophisticated data center owner-operators necessarily know what their utilization rates and load shapes will look like,” Norris wrote in an August blog post. “Their preference is generally to maintain maximal optionality” — that is, to demand as much access to as much always-available power as they can get.

Nor do data centers have a clear path to achieve the kind of flexibility that utility planners may demand, said Ben Hertz-Shargel, global head of grid-edge research for analytics firm Wood Mackenzie.

“There are two main ways to make data centers flexible,” Hertz-Shargel said. “You can make the compute flexible. Or you can use backup generation, which is almost always diesel today.”

But data centers can’t run megawatts of noisy, polluting, and expensive diesel generators without running afoul of air-quality regulations and enraging neighbors, he said. True flexibility will require more novel options like gas-fired generators and batteries charged from the grid or on-site solar systems, he added.

Meanwhile, flexible computing is in its early stages. Of the major tech giants, only Google has actively engaged with utilities to shift computing to match grid needs. Experiments from companies such as Emerald AI have shown “some auspicious results,” Hertz-Shargel said. “But for the industry to count on that, it’s too early.”

Utilities and regulators will also need to adapt how they plan for serving flexible data centers, Telos Energy’s Stenclik said. Today, they’re taking on rising data-center costs in a multitude of ways, from crafting special tariffs to govern their impact to allowing tech giants to contract for 24/7 clean energy resources in order to supply their power demands. But he wasn’t aware of any utility that has undertaken a real-world version of the kind of demand-side flexibility analysis that GridLab and Telos did.

Utilities should start working on it, given the alternatives, he said. “We’re leading to higher total capacity needs. We’ve seen huge challenges on the supply chain. We’re out five, six years from new gas turbines now,” he estimated.

“I think there’s a ton of latent flexibility,” he concluded. “We’re just asking for it at the wrong time. If you ask for it when they’re already built and designed and on the system, the answer is going to be no. If we trade speed to interconnect for flexibility, I think the answer will absolutely be yes.”

Investment in cleantech startups is tracking toward the lowest level in years. But Base Power shrugged off the market trends and just raised $1 billion to turbocharge its home battery buildout.

The colossal Series C funding round comes only six months after it raised $200 million in an April Series B. Addition led the latest round, which brought back all previous investors, including Andreessen Horowitz and Valor Equity Partners. The company’s valuation now stands at $4 billion after receiving the new investment, Base Power founder and CEO Zach Dell said.

The pace and scale of those investments put the Austin, Texas–based firm in a league of its own among clean energy startups this year — beating out even the outlandish $863 million that Commonwealth Fusion Systems raised in August. Dell says his company’s traction comes down to a very clear value proposition: It’s potentially the fastest way to expand on-demand grid power at a time when everyone wants more of it.

“Right now, we’re in a capacity crunch — everyone needs capacity,” Dell said. “We install capacity faster and cheaper than really anyone out there.”

The U.S. is going through the fastest electricity demand growth in decades, as AI data centers proliferate, more factories open up, and customers purchase electric vehicles. Utilities have long maintained a skeptical stance toward startups’ plans to turn home energy devices into substantial forces on the grid; now, Dell said, they’re not just willing but “more excited than ever” to have that conversation.

The key to Base Power’s model is finding households in Texas who want cheap electricity with the benefit of backup power. The company becomes their retail power provider and installs one or two unusually large batteries on-site. Base owns the batteries, and the customers pay an installation fee starting at $695 and a small monthly rate instead of purchasing them for many thousands of dollars. Then the startup aggregates this dispersed fleet of batteries to essentially create miniature power plants it can profit from in the state’s competitive energy market.

The batteries earn money through simple arbitrage: They charge up when wind or solar production pushes prices down and then discharge when demand and prices spike. Base Power also earned certification to deliver ancillary services, which are rapid-fire adjustments to maintain grid reliability, for which batteries are uniquely suited. The company has already maxed out the 20 megawatts it can bid through the Aggregate Distributed Energy Resource pilot, a virtual-power-plant program, and is pushing for the cap to be raised, Dell said.

Base Power has begun selling its services to regulated utilities so that they can help their customers with backup power and free up more grid capacity. And Dell is scoping out other geographical markets where the rules could allow the Base Power model to grow. But for now, Texas is the ideal place to start. It not only has the competitive market run by the Electric Reliability Council of Texas, or ERCOT, but it is also awash in more utility-scale solar and wind than any other state, enhancing the value of battery-based arbitrage.

When Dell spoke to Canary Media for the previous fundraise, he employed 100 people, and his in-house teams were installing 20 home battery systems per day, for a total of about 10 megawatt-hours in March. Now Base Power employs 250 people and installs double that rate. A year from now, Dell wants to install 100 megawatt-hours per month.

That’s a brash goal for a 2-year-old company. But Base Power has actually followed through on its goals, a rare distinction among buzzy cleantech startups. In April, Dell had promised 100 megawatt-hours of cumulative installations by midsummer; he hit that target and is now approaching 150 megawatt-hours.

The firm has also been planning to move from contract manufacturing for its bespoke battery enclosures to in-house manufacturing. In April, Dell said he planned to break ground on a factory near Austin by the end of the year. Now the company has leased the old Austin American-Statesman newspaper headquarters in the heart of town and has begun moving in manufacturing equipment.

“It’s a 90,000-square-foot empty warehouse that happens to be right across the street from our HQ. There’s massive amounts of benefits you get from colocating engineering and manufacturing — having the engineers be really close to the factory, being able to walk the line and make iterations in real time.”

This factory will take imported battery cells and build the modules, packs, and power electronics needed to turn them into large home-battery products. The plan is to start manufacturing in the first quarter of 2026 and ramp up to 4 gigawatt-hours per year of production capacity, Dell said. This supply chain strategy also shores up compliance with new federal rules limiting tax credits for batteries that contain too much content from China.

Base Power is already finalizing a location for a “much, much larger” facility outside Austin to continue growing its manufacturing capacity.

Other startups have opted for “capital light” strategies to get solar or batteries into the hands of customers. Base Power, in contrast, went capital-heavy, fronting the money to design, own, and install the batteries with the expectation of making future profits on their capacity. It’s too soon to know how that business bet will play out over years, but Dell indicated the early returns were attractive.

“It’s hard to raise a billion dollars without that,” he noted. “The math is indeed mathing.”

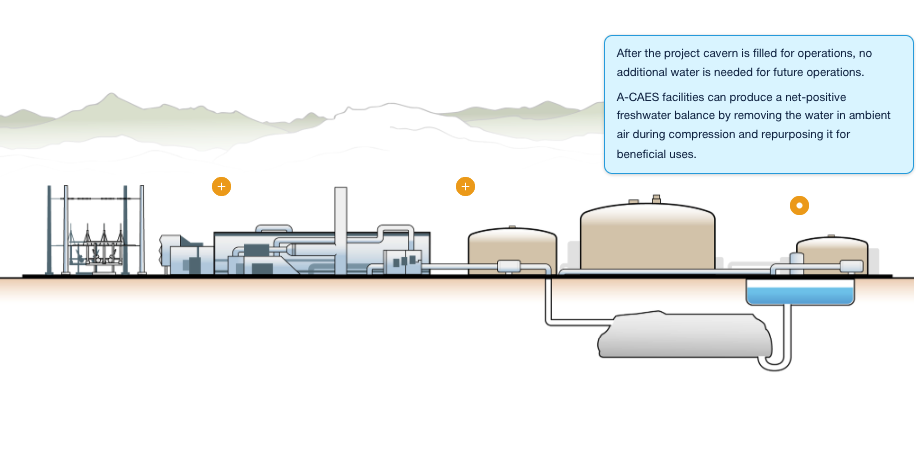

What is A-CAES?

Advanced compressed air energy storage (A-CAES) is a technology that stores energy by compressing air and later releasing it to generate electricity. It is an enhanced form of traditional compressed air energy storage (CAES), which has been in use in California and other parts of the world for decades. Hydrostor’s key advancement is that A-CAES captures and stores the heat generated during the compression phase and uses it to reheat the air during expansion, which significantly improves efficiency while eliminating the use of fossil fuels for daily operations. This patented technology makes it a much more environmentally friendly and cost-effective method for large-scale, long-duration energy storage.

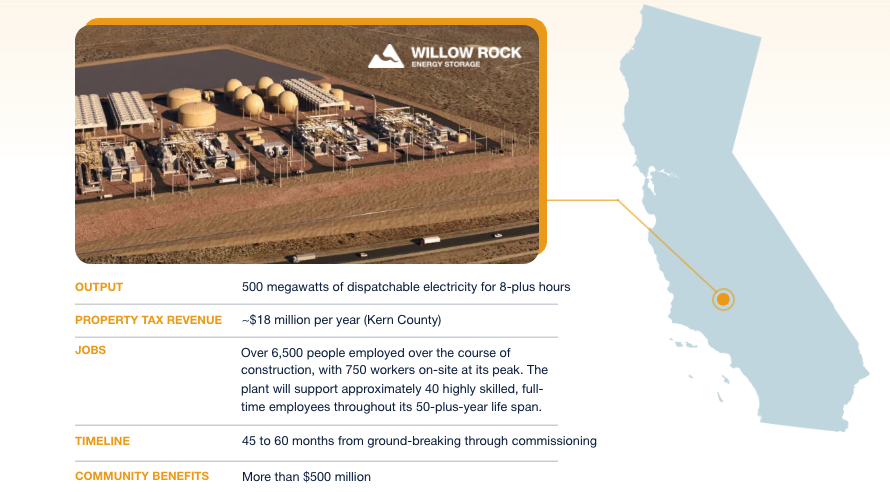

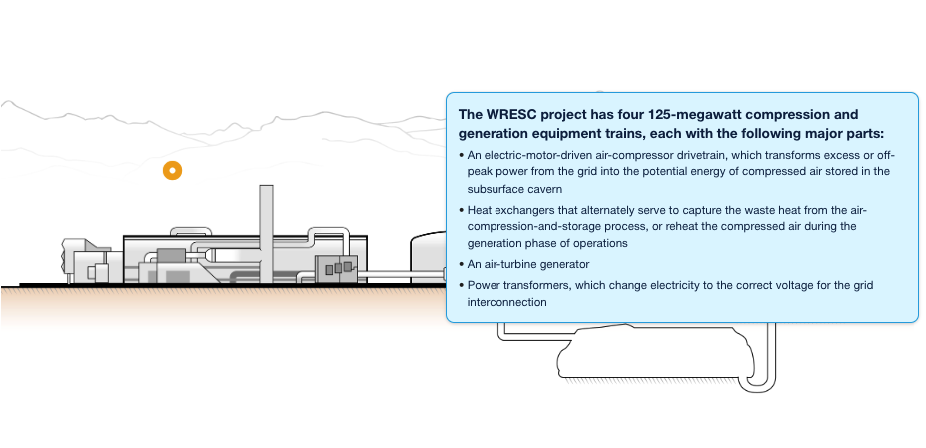

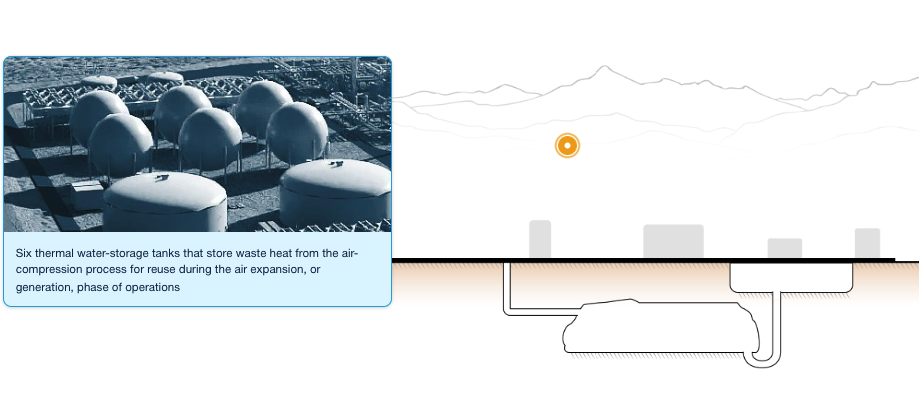

Take a look at how Hydrostor’s Willow Rock Energy Storage Center (WRESC) project in Kern County, California, is contributing to the state’s energy priorities:

From drawing board to full operation: a phased approach

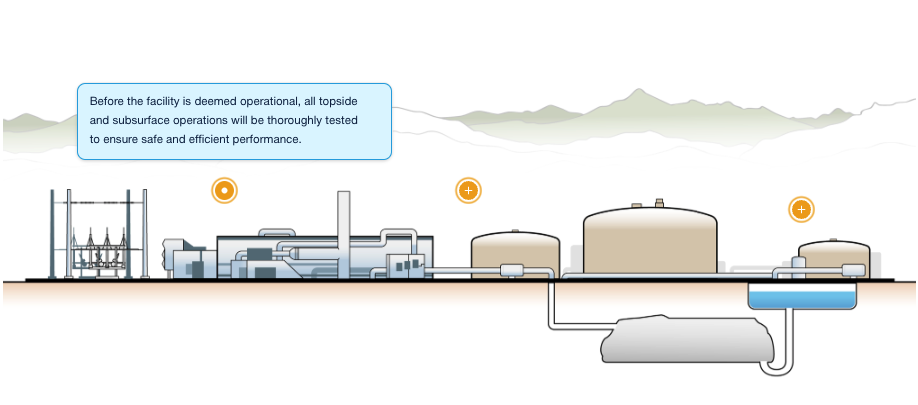

Construction of the Willow Rock project is anticipated to take 60 months from the time the project breaks ground until it goes online. The construction work will take place in six phases:

Preconstruction

Before any physical work can begin on a project of this scale, Hydrostor does substantial preliminary work to ensure there are minimal impacts to the surrounding communities and environment. Preconstruction assessments completed for the Willow Rock Energy Storage Center evaluated potential impacts on air quality, cultural resources, geologic conditions, soil health, water quality, and other factors and included recommendations on how to mitigate those impacts. An extensive permitting process will involve consulting with the local community, state agencies, and federal agencies before construction begins. A-CAES facilities have a smaller physical and environmental footprint than other energy infrastructure, using five to 20 times less water than pumped hydro and more than 10 times less land than solar for an equivalent amount of energy.

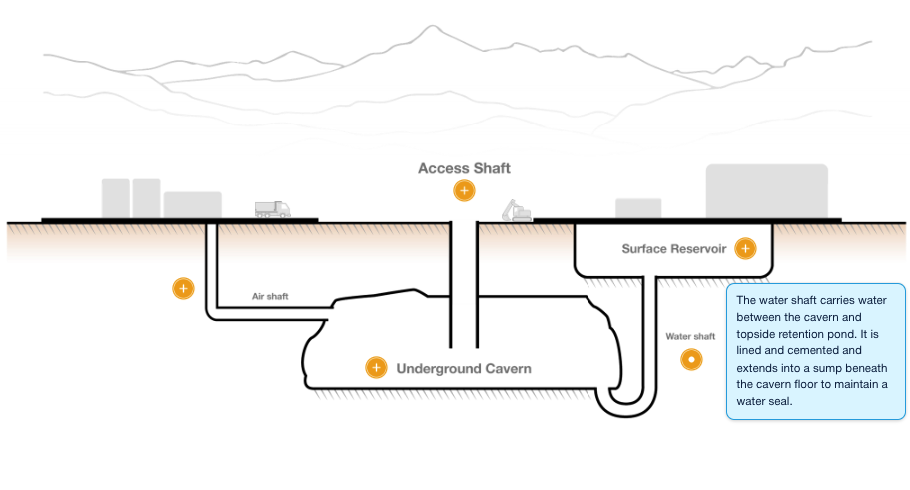

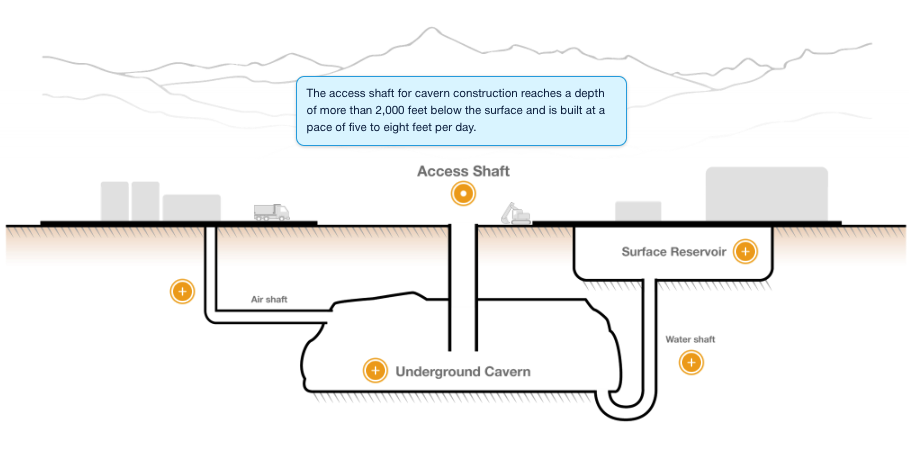

Cavern Construction

The first parts of an A-CAES facility to be built are the underground cavern and its associated air, water, and construction shafts. The storage cavern is constructed in bedrock approximately 2,000 to 2,500 feet belowground. This subsurface work is the most time-consuming portion of construction, taking roughly three years.

Topside Construction

Once the subsurface construction is underway, topside construction begins. This phase includes installing turbines, thermal storage tanks, and the rest of the facility’s aboveground equipment in addition to constructing the transmission line.

Transmission

The Willow Rock Energy Storage Center is located near the project’s transmission interconnection point, the SCE Whirlwind Substation, thereby reducing the time, cost, and complexity of building the transmission infrastructure.

Once construction is complete, all project equipment will be rigorously tested for safety and efficiency before Willow Rock officially begins providing reliable power to millions of Californians.

Willow Rock’s 50-Plus Year Commercial Life Span

Once operational, A-CAES facilities like Willow Rock — unlike many other energy storage technologies — will operate with zero efficiency loss over its expected commercial life span of 50 years or more. This means Hydrostor’s work in host communities—and the jobs it creates to operate each facility—are long-term commitments that provide lasting local and regional benefits.

A-CAES projects' flexible siting, energy density, environmental attributes, and community benefits make them an excellent fit for many regions across the U.S. Learn more about Hydrostor's growing project pipeline here.

California Governor Gavin Newsom has vetoed three bills that aimed to boost the use of virtual power plants, undermining an opportunity to decrease the state’s fast-rising electricity costs and increase its grid reliability.

On Friday, Newsom vetoed AB 44, AB 740, and SB 541, which were passed by large majorities in the state legislature last month. Each bill proposed a distinct approach to expanding the state’s use of rooftop solar, backup batteries, electric vehicles, smart thermostats, and other customer-owned energy technologies.

In three separate statements, Newsom argued that the bills would complicate state regulators’ existing efforts to use those technologies to meet clean energy and grid reliability goals.

The moves come as utility costs reach crisis levels in California; its residents now pay roughly twice the U.S. average for their power.

In response, Newsom did sign into law a package of bills aimed at combating cost increases at the state’s three major utilities: Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric. But some supporters of the virtual power plant (VPP) bills speculated that these same utilities were to blame for Newsom’s vetoing legislation that could have further driven down costs, as the governor has received significant campaign contributions from PG&E and the policies would have eaten into utility profits.

“These vetoes effectively stall progress on key distributed energy and affordability strategies,” said Kurt Johnson, community energy resilience directorat the Climate Center, a nonprofit group. “Policies and programs in California continue to be killed because they threaten the economic interests of California’s powerful investor-owned utilities.”

Izzy Gardon, Newsom’s director of communications, declined to comment on these critiques in an email response to Canary Media, saying, “The Governor’s veto messages speak for themselves.”

But Edson Perez, who leads California legislative and political engagement for clean-energy trade group Advanced Energy United, argued that the justifications cited in the veto statements fail to adequately consider the value the state’s increasingly large numbers of rooftop solar systems, backup batteries, EVs, and smart appliances can deliver to the grid.

An August report from think tank GridLab and grid-data analytics startup Kevala found that California could cut energy costs for consumers by between $3.7 billion and $13.7 billion in 2030 by triggering home batteries, EV chargers, and smart thermostats to reduce summertime grid demand peaks that drive an outsize portion of utility grid costs.

The Brattle Group, a well-regarded energy consultancy, found in a 2024 analysis that VPPs could provide more than 15% of the state’s peak grid demand by 2035, delivering $550 million in annual utility customer savings. Simply put, paying homes and businesses for the grid value of devices they’ve already bought and installed is cheaper than the alternative of utilities building out new poles and wires and substations to serve peak demand.

“These distributed energy resources are already deployed, connected to customers, and connected to the internet,” Perez said. “The longer we wait to tap into this potential, the longer we waste away the savings.”

To date, the VPP programs run by California’s major utilities have failed to capture that savings value. In fact, the programs administered by the California Public Utilities Commission (CPUC) have seen their overall capacity fall over the past five years or so, even as installations of the underlying technologies have risen.

The saving grace for VPPs in California has been the Demand Side Grid Support program, which is administered by the California Energy Commission (CEC) and has expanded rapidly in the past three years. A Brattle Group study released in August found that the roughly 700 megawatts of capacity from solar-charged batteries in homes and businesses enrolled in the DSGS program could save California utility customers from $28 million to $206 million over the next four years.

But last month the DSGS program was stripped of its funding during last-minute negotiations between legislative leaders and Newsom’s staff, leaving its future in doubt.

That’s frustrating to companies like Sunrun, the leading U.S. residential solar and battery installer, which has enlisted customers in California to supply hundreds of megawatts of DSGS capacity from their solar-charged batteries.

“Do we want to leverage existing infrastructure — electrons in batteries that are already there — and non-ratepayer capital to lower rates for everyone in creating a more efficient and smarter grid?” said Walker Wright, Sunrun’s vice president of public policy. “Yes or no?”

Because of changes made during closed-door negotiations in August, the VPP legislation vetoed by Newsom was relatively limited, but it still would have made a positive difference had it passed, said Gabriela Olmedo, regulatory affairs specialist at EnergyHub, a company that manages demand-side resources and virtual power plants in the U.S. and Canada.

“These were unopposed bills that were pretty uncontroversial but would have made impactful steps toward enhancing load flexibility in California,” she said. “We can’t afford to keep leaving these readily available and affordable solutions off the table.”

SB 541, for instance, would have authorized the CEC to create regulations to track the progress toward a state-mandated goal of achieving 7 gigawatts of “load shift” capacity by 2030 across utilities, community energy providers, and other entities supplying power to customers. Newsom’s veto statement said the bill would have been “disruptive of existing and planned efforts” by the CPUC, CEC, and state grid operator CAISO.

“I’m disappointed in this veto,” state Senator Josh Becker, the Democrat who authored SB 541, said in a statement to Canary Media. “This bill was about affordability,” he said. “Next year this area will be a focus of the clean energy community. Clearly we have some educating to do.”

AB 44 would have authorized the CEC to expand a method it has used to help some of California’s community choice aggregators (CCAs) tap VPPs to reduce peak demand.

Newsom’s veto statement declared that the bill “does not align” with the long-running effort by the CPUC to reform the Resource Adequacy program that sets the rules for how these grid needs are met. But critics say the CPUC has consistently failed to allow VPPs and other distributed energy resources to offset the increasingly high prices that utilities and CCAs are bearing to meet those needs.

AB 740 would have instructed the CEC to work with the CPUC, CAISO, and an advisory group representing disadvantaged communities to adopt a VPP deployment plan by November 2026.

Newsom’s veto statement declared that the bill would result in “costs to the CEC’s primary operating fund, which is currently facing an ongoing structural deficit.” But critics have pointed out that the text of the law would have instructed the VPP plan only to move forward “subject to available funding,” which would have forestalled any budget impacts.

“Even if it were signed, it would not have to be implemented unless the state budget proactively funded it,” Perez said. “It is very disappointing that we can’t even have the agencies talk about this in a comprehensive way. It’s kind of shocking that even that’s not allowed.”

California has labored for years to build enough clean energy to wean itself off fossil fuels. Now the effort is paying off in an undeniable way.

President Donald Trump’s Department of Energy might tweet that solar plants are “essentially worthless when it is dark outside.” But in California, batteries are proving the opposite, by shifting ever more solar into evening and nighttime hours. Consequently, solar generation hit new highs in the first half of the year, and fossil-gas generation has fallen rapidly in turn.

From January to July, as noted by Reuters, solar generation delivered 39% of the state’s generation, a record level, while fossil fuels provided just 26%, a new low since the dawn of modern gas power. In April, a temperate shoulder month, gas generated less than 20%. For context, across all of last year, solar provided 32% of California’s power — the highest rate of any U.S. state — nearly unseating gas as the largest source of power.

These trends have resulted in numerous clean energy records this summer. In the California Independent System Operator’s grid, which serves most of the state, solar delivered a record 21.7 gigawatts just past noon on July 30. Two days later, at 7:30 p.m., the battery fleet set its own record, nearing 11 gigawatts of instantaneous discharge for the very first time (it has since beat that record).

California’s electricity supply increasingly diverges from the nation’s. Gas has predominated since 2016, and now accounts for more than 40% of U.S. generation; coal, meanwhile, has fallen to around 16%. The carbon-free cohort includes nuclear and renewables at around 20% each. Solar, including rooftop systems, provided about 7% of U.S. electricity last year, according to Ember.

Initially, California’s billions of dollars in solar subsidies and suite of supporting policies couldn’t overcome the state’s gas dependency. The solar systems cranked out excess power through the sunny hours, much of which got curtailed for lack of simultaneous demand, then California turned to fossil fuels to keep the lights on at night. That addiction at times overpowered the state’s environmental ethos: California even opted in 2020 to waive enforcement of a regulation protecting marine life because it would have shuttered a number of coastal gas plants that the grid wasn’t ready to lose, despite having a decade to prepare for the rule.

Such desperation gave temporary succor to solar skeptics and gas boosters. But when an energy system starts to change, snapshots in time are less instructive than the trend lines. And California’s trend lines have been pointing in one direction.

While the state hasn’t been building new gas generation, it has connected gigawatts of new solar and batteries each year. These resources are nearly free to operate once built, while gas plant owners have to buy fuel to combust and keep complex machinery in fine working order. And the price of gas has been going up, amid greater demand both at home (due to data center expansion) and abroad (with liquefied exports going to the highest bidder). Now California’s gas plants have more competition in the peak hours from cheaper, cleaner resources; they’re getting squeezed toward fewer hours of intense demand.

But it would be a mistake to think that these trends stop at the Sierra Nevada. Indeed, these patterns are playing out nationally: Very little new gas capacity is getting built, quite a lot of solar and batteries are, and gas prices are going up.

Some regions allow developers to respond nimbly to these trends, namely Texas, which indeed has leapt ahead of California in its pace of solar and storage installations. Other regions obstruct such dynamism and face the consequences, like the mid-Atlantic wholesale markets run by PJM, where skyrocketing capacity auctions are pushing costs to crisis levels.

California’s grid overhaul has been a long time coming, and one lesson here is that big changes — like redesigning the energy system for the world’s fourth largest economy — take time. But other states won’t have to wait as long: They can tap into a mature supply chain that scaled up thanks to California and other early adopters, plus the industrial expertise to design and manage large solar construction efforts and the financing options de-risked by years of data from earlier projects.

The federal government is trying to stymie renewables however it can. But California is demonstrating the rewards for getting solar to escape velocity, and that momentum is set to carry forward in the coming years.

America’s fledgling carbon-removal industry is on edge following funding cuts from the Trump administration — and rumors of even further clawbacks to follow.

On Tuesday, a list of potential U.S. Department of Energy award terminations shared with Canary Media, and which circulated in Washington, included two giant direct-air-capture (DAC) hubs planned in Louisiana and Texas. Each project has received about $50 million to begin planning and developing CO2-sucking facilities, and together they are slated to receive up to $1.1 billion in federal support.

However, a spokesperson for DOE said that it is “incorrect to suggest those two projects have been terminated” and that no determinations have been made beyond the award cancellations announced last week. On Oct. 2, the agency said it was scrapping 321 grants totaling over $7.5 billion — including nearly $50 million to help 10 smaller DAC initiatives begin concept and engineering studies for future installations.

“The Department continues to conduct an individualized and thorough review of financial awards made by the previous administration,” DOE press secretary Ben Dietderich said in an email to Canary Media. Following last week’s cancellations, Energy Secretary Chris Wright said more cuts would be announced, though he did not specify further.

The real and rumored grant terminations reflect the chaos and confusion that’s engulfed virtually every federally backed energy project since the start of the second Trump administration. Even developers whose awards haven’t been slashed — at least not yet — must try to navigate the lengthy and complicated funding process with an agency wracked by layoffs.

For carbon removal in particular, “a lot of these projects have kind of been in limbo this year, not sure of if they should commence and continue their work,” said Courtni Holness, the managing policy adviser for the nonprofit Carbon180. “There’s a lot of uncertainty around if they’re going to get continued funding, if they’ll be able to be reimbursed.”

While cutting greenhouse gas emissions is the most urgent and necessary way to tackle climate change, the world will also need to remove CO2 from the atmosphere in order to avert the worst consequences of a warming planet, climate scientists say. However, most carbon-removal solutions are early-stage, expensive, and largely unproven at any meaningful scale, making government support critical to their success.

The Biden administration launched the Regional Direct Air Capture Hubs program in 2023 with $3.5 billion in funding provided by the 2021 bipartisan infrastructure law. The DAC initiative was part of a broader push by the DOE to help the private sector deploy novel technologies at commercial scale.

Funding for the Louisiana and Texas megaprojects “represented the largest ever public investment in carbon removal,” said Erin Burns, executive director of Carbon180. If completed as planned, the hubs are each expected to create thousands of jobs in the regions where they’ll operate.

The South Texas DAC Hub is an initiative of the Occidental Petroleum subsidiary 1PointFive. The project is located just south of Corpus Christi and is expected to be capable of removing over 1 million metric tons of CO2 per year — roughly equal to the annual emissions from 2.5 gas-fired power plants. The project will use technology developed by Carbon Engineering, a company that 1PointFive acquired for $1.1 billion in November 2023.

DAC plants can use giant industrial fans to draw in large amounts of air, then separate out the carbon using chemical solutions or filtered materials. The captured CO2 can be injected into deep geological formations, or it can be repurposed to make valuable industrial products, such as concrete and synthetic fuels.

1PointFive didn’t immediately return Canary’s request for comment on the purported DOE funding cuts.

The company is separately building another DAC facility in the Texas Permian Basin that is designed to capture up to 500,000 metric tons of CO2 annually and could begin operating later this year. That project, called Stratos, will likely use captured carbon for “enhanced oil recovery,” a process that involves pumping the gas into older oil wells to force up any remaining fossil fuels.

Although Stratos didn’t receive a DOE grant, the operation will still likely benefit from the federal 45Q tax credit, which was expanded under the GOP budget law that passed in July — mainly for the benefit of carbon-capturing projects linked to oil production.

Meanwhile, in Louisiana, a coalition of companies is building a DAC hub called Project Cypress. Climeworks and Heirloom, two leading carbon-removal developers, are partnering with the applied-sciences organization Battelle to design and operate two facilities, which together are intended to capture over 1 million metric tons of carbon per year. The company Gulf Coast Sequestration will then take the captured CO2 and permanently store it in a deep saline aquifer.

Climeworks, a Swiss company, will use its fan-driven technology, a version of which is already operating in Iceland. The U.S. startup Heirloom will build a separate plant for its own DAC process, which involves heating trays of limestone inside kilns to turn the mineral into a “sponge” that absorbs CO2 from the atmosphere.

Vikrum Aiyer, Heirloom’s head of global policy, said on Tuesday that the company wasn’t “aware of a decision from DOE” to cancel its federal award and that the companies continue “to productively engage with the administration in a project review.”

Both the South Texas and Louisiana DAC hubs still face significant hurdles to crossing the finish line — including sourcing massive amounts of clean electricity to run their machines — even if they ultimately receive federal funding as promised. 1PointFive, for example, has run into local opposition, in part because of its association with the fossil fuel industry. Community advocates in both states have said they felt shut out of early planning processes that should have included them.

For DAC proponents, rescinding federal awards means the U.S. could risk losing out on the potential jobs and investment these first-of-a-kind projects are expected to create, especially as other countries press ahead. China, for example, has announced plans to build 37 domestic “carbon management and removal” projects by 2030, according to the Carbon Removal Alliance.

“Carbon removal is essential to meeting our climate targets and fueling energy security — that’s why it’s the world’s next trillion-dollar industry,” Carbon Removal Alliance and another advocacy group, the Carbon Business Council, said in a joint statement.

The future of community solar is dimming, hampered by federal attacks on clean energy and shifts in state markets.

Installations of the shared-solar approach took a nosedive in the first half of 2025, dropping by 36% from the same period last year, according to a new report by consultancy Wood Mackenzie.

Working in collaboration with the Coalition for Community Solar Access, an industry trade group, Wood Mackenzie forecasts that by the end of 2025, installations will fall by 29% from 2024’s record high of 1.7 gigawatts. According to the analysis, growth will likely contract by an average of about 12% annually through 2030.

“I’m dismayed by this report,” said John Farrell, co-director of the research and advocacy nonprofit Institute for Local Self-Reliance. “Of the places where we have policies [that drive community solar], it looks like things are slowing down.”

Community solar makes clean power accessible to those who can’t put solar panels on their roofs — be it because they rent, can’t afford them, or have other reasons. Households can subscribe to a share of an off-site array, which is typically 2 to 20 megawatts, per the report, to get credit for the power and save on their energy bills. Third-party developers usually build and own these installations — not utilities.

About 9.1 gigawatts of shared solar have been installed in the U.S. to date, according to the report’s authors. They expect community solar capacity to reach roughly 16 GW by 2030.

The megabill that Republicans passed in July is a major reason for the community solar market’s shake-up. The law set an early expiration date for a key tax credit worth 30% to 50% of the cost of a project. Developers once had until 2034 to claim it; now companies must either start construction by July 2026 and finish within four years or start producing power by the end of 2027.

Because of the law’s passage, Wood Mackenzie slashed its community solar figures through 2030 by about 8%, or 655 megawatts, from its prior forecast, said Caitlin Connelly, senior analyst at the firm and lead author of the report.

But factors at the state level are also contributing to the slowdown. In particular, New York and Maine are driving the steep decline.

Developers in New York, a mature market, are having trouble finding sites, paying higher permitting and land costs, and having to wait an average of nearly three years to get connected to the grid, making projects more expensive to develop, Connelly said.

Meanwhile, in Maine, two regulatory changes are at play. Last year saw record growth as developers sprinted to get projects done by the December phaseout of the state’s net metering program, leading to fewer in the pipeline now, Connelly noted. In June, legislators also passed a bill that retroactively overhauled compensation for community solar power and added fees for new and established projects. The industry has said these provisions will make the state a “pariah for investors.”

Some states, such as Virginia and New Mexico, also have caps on the size of their community solar programs that are limiting new developments, according to Connelly.

And more federal turbulence could be ahead.

The Trump administration is also trying to claw back funding that would’ve supported solar: the $7 billion Solar for All program and the $20 billion Greenhouse Gas Reduction Fund, programs passed under the landmark Inflation Reduction Act.

“The impact of [losing] Solar for All is one that we are tracking closely,” Connelly said, as the move could stymie community solar in places where it’s just getting off the ground.

While this year is likely to be a rough one for community solar, Connelly sees growth returning in 2026 and 2027. This is in part due to rebounds in Massachusetts and New Jersey, both of which are transitioning into new iterations of existing programs.

Massachusetts will open up its Solar Massachusetts Renewable Target program, SMART 3.0, to developers on October 15. And New Jersey recently eliminated a 150-megawatt annual cap and unlocked a whopping 3 gigawatts of community solar capacity.

But that growth is just a temporary reprieve. Over the longer term, the forecast shows community solar installations trending down.

A few factors could change the sector’s fortunes, however.

For one, if states were to start new community solar programs, as well as address interconnection bottlenecks, they could drive up to 1.3 gigawatts of additional capacity through 2030, according to the report. But “we don’t really see any new programs opening up, at least in the near term,” Connelly said. “Policymakers have made a lot of progress in some state markets over the last six months to a year, but the difficulty is getting that legislation over the finish line.”

In deep red Montana, for example, legislators approved a new community solar program, with 100 in favor and 50 opposed, underscoring the model’s growing appeal to Republicans. But Gov. Greg Gianforte (R) vetoed the bill, claiming that it could result in “unreasonable costs” being foisted on other energy customers.

Only 24 states plus Washington, D.C., have passed community solar legislation as of February, according to the National Renewable Energy Laboratory. Wisconsin, Michigan, Ohio, and Iowa are all considering shared-solar bills, said Jeff Cramer, president and CEO of the Coalition for Community Solar Access.

Other states could be tempted to authorize a flood of clean, cheap solar power. The grid is facing soaring demand from data centers, electric vehicles, buildings, and manufacturing, and distributed community solar is among the fastest options to deploy.

“If you want to build a new gas plant right now, you’re going to need five-plus years minimum to do it. You want to build a new utility-scale [solar or wind] facility — at least five years as well, and that’s pending the development of new transmission,” Cramer said.

By contrast, community solar has a typical development timeline of six months to two years, he added. “The only kind of capacity that we can build close to load and faster than those timelines to meet load growth and grid congestion is distributed solar.”