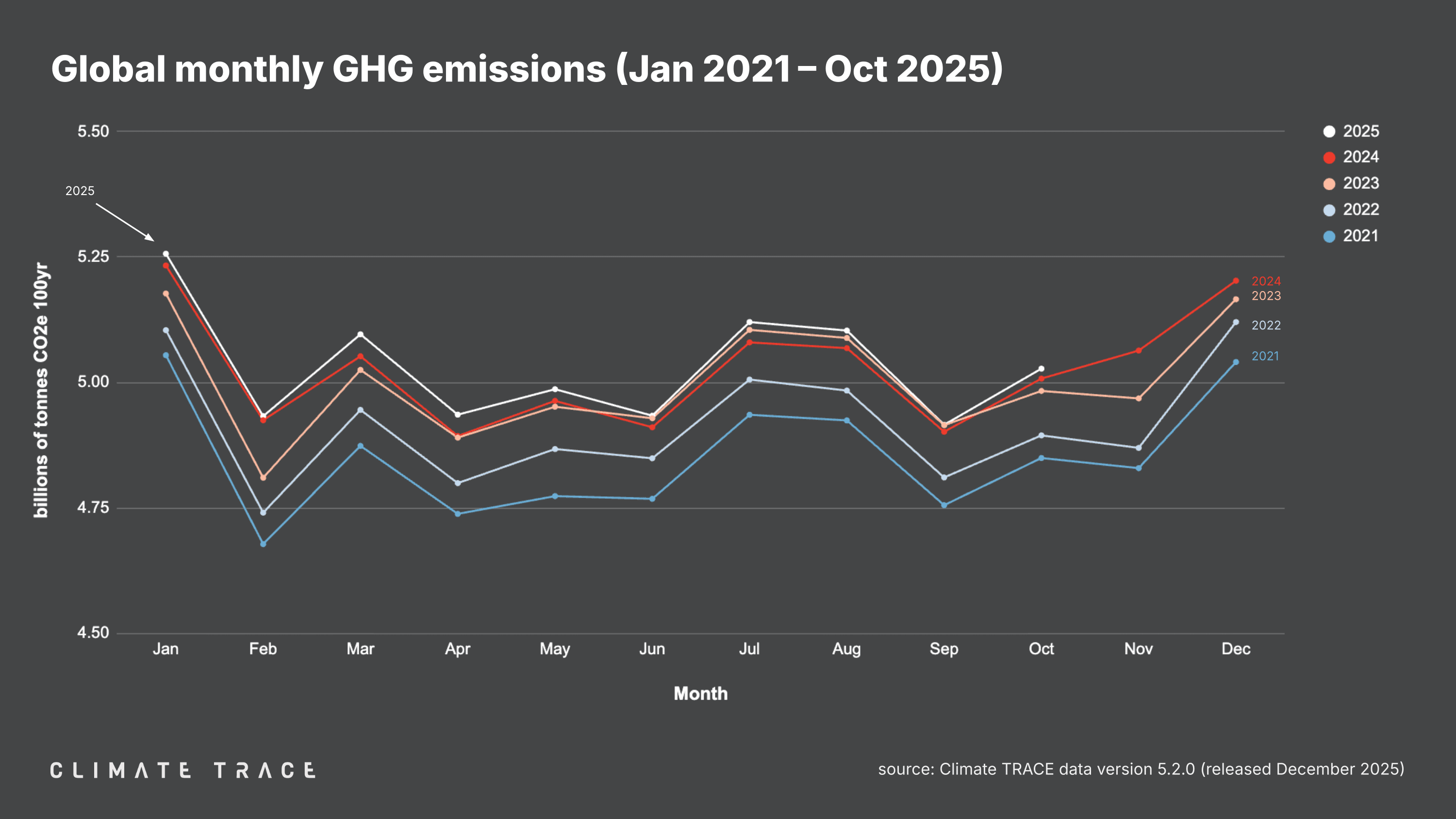

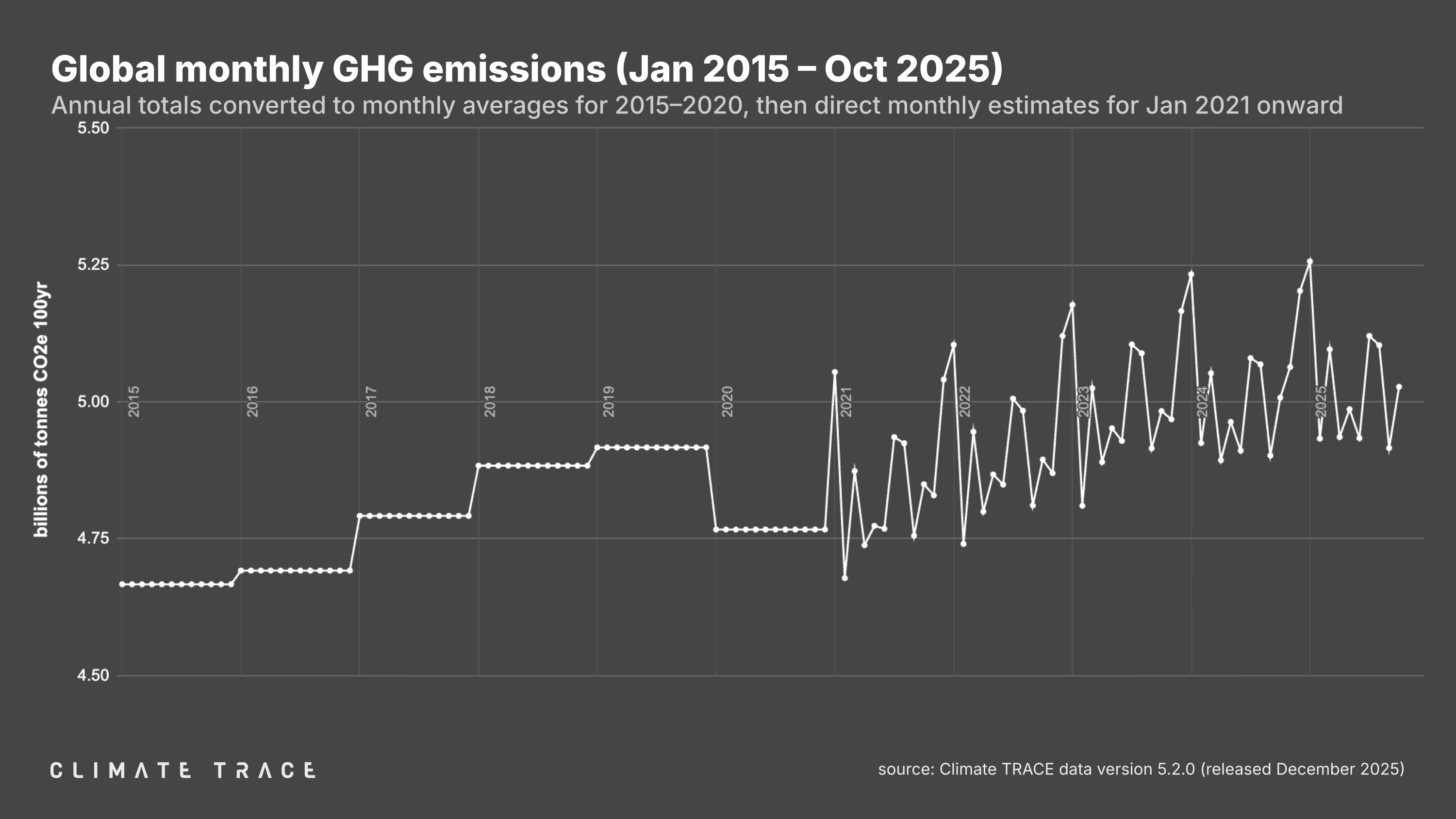

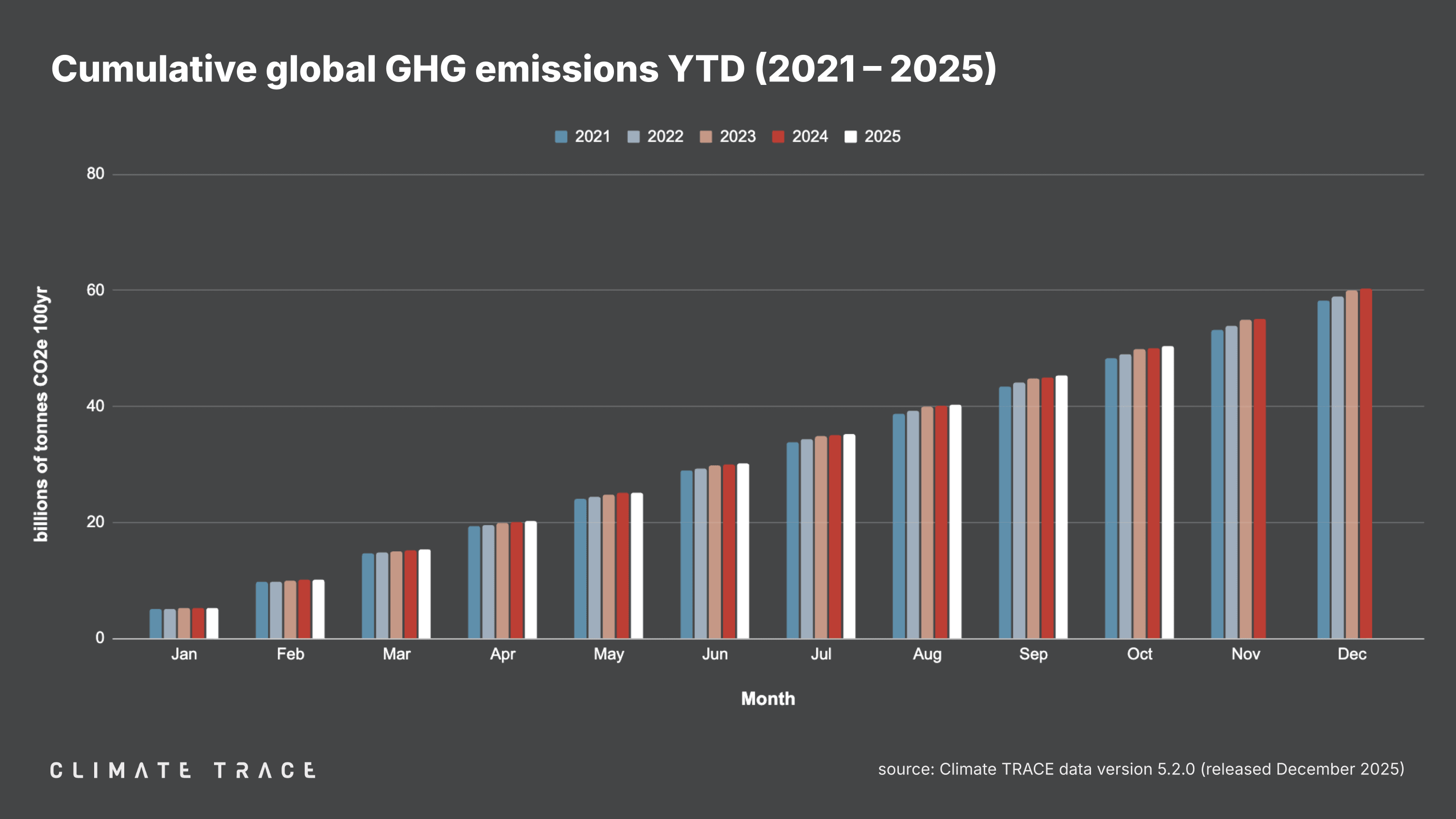

December 18, 2025 – Today, Climate TRACE reported that global greenhouse gas (GHG) emissions for the month of October 2025 totaled 5.03 billion tonnes CO₂e. This represents an increase of 0.40% vs. October 2024. Total global year-to-date emissions are 50.31 billion tonnes CO₂e. This is 0.55% higher than 2024's year-to-date total. Global methane emissions in October 2025 were 33.83 million tonnes CH₄, an increase of 0.07% vs. October 2024.

Data tables summarizing GHG and primary particulate matter (PM2.5) emissions totals by sector and country, and GHG emissions for the top 100 urban areas for October 2025 are available for download here.

Greenhouse Gas Emissions by Country: October 2025

Climate TRACE's preliminary estimate of October 2025 emissions in China, the world's top emitting country, is 1.42 billion tonnes CO₂e, an increase of 8.46 million tonnes of CO₂e, or 0.60% vs. October 2024.

Of the other top five emitting countries:

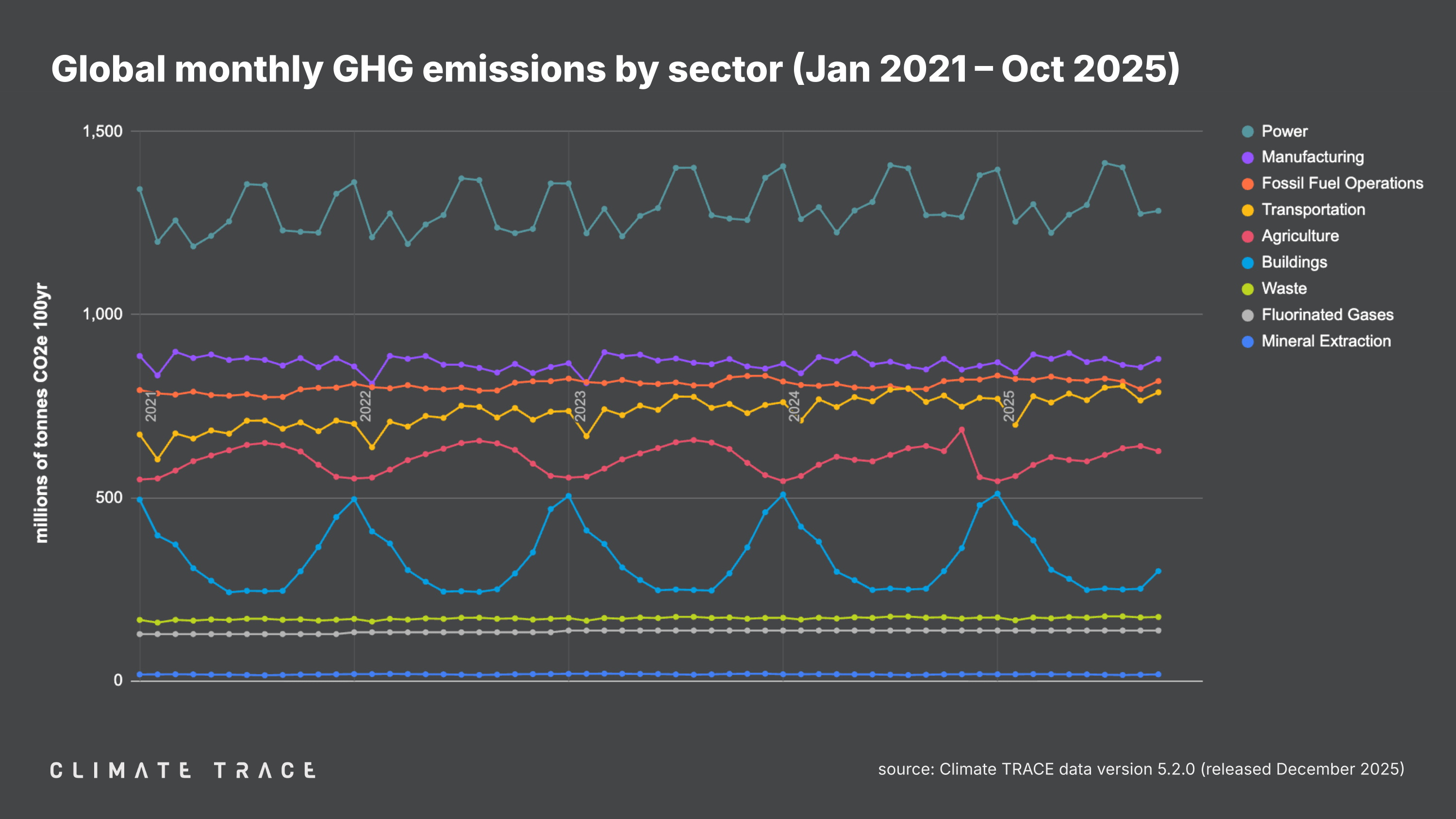

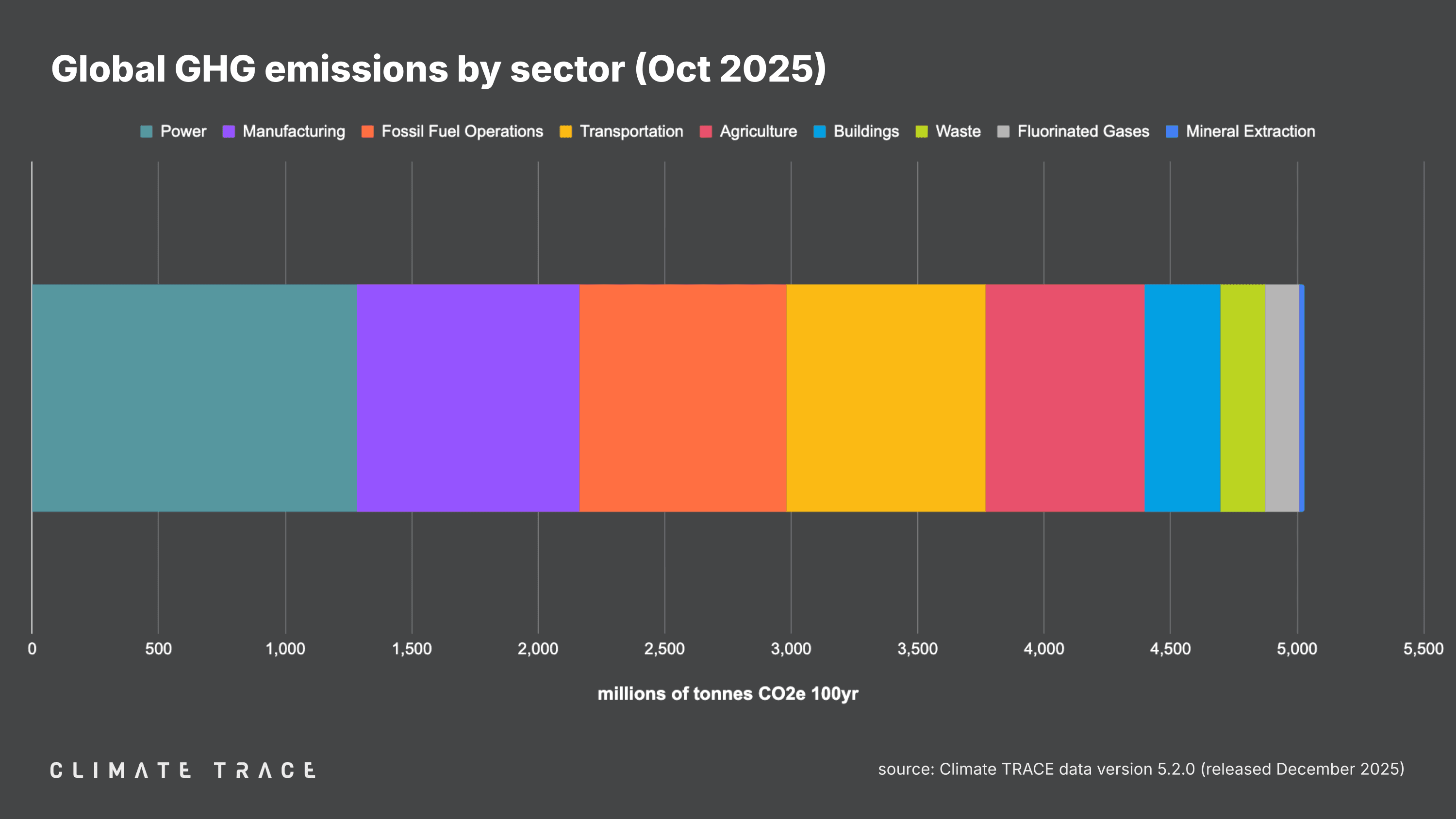

Greenhouse Gas Emissions by Sector: October 2025

Greenhouse gas emissions increased in October 2025 vs. October 2024 in power, transportation, and waste, and did not decrease in any major sectors. Transportation saw the greatest change in emissions year over year, with emissions increasing by 1.13% as compared to October 2024.

Greenhouse Gas Emissions by City: October 2025

The urban areas with the highest total GHG emissions in October 2025 were Shanghai, China; Tokyo, Japan; Houston, United States; New York, United States; and Los Angeles, United States.

The urban areas with the greatest increases in absolute emissions in October 2025 as compared to October 2024 were Ramagundam, India; Obra, India; Newcastle, Australia; Toranagallu, India; and Owensboro, United States. Those with the largest absolute emissions declines between this October and last October were Waidhan, India; Korba, India; Anpara, India; Rotterdam [The Hague], Netherlands; and UNNAMED, India.

The urban areas with the greatest increases in emissions as a percentage of their total emissions were Butibori, India; Uruguaiana, Brazil; Shitang, China; Obra, India; and Shostka, Ukraine. Those with the greatest decreases by percentage were Heilbronn, Germany; UNNAMED, India; Santaldih, India; Petropavlovsk-Kamchatsky, Russia; and Alotau, Papua New Guinea.

RELEASE NOTES

Revisions to existing Climate TRACE data are common and expected. They allow us to take the most up-to-date and accurate information into account. As new information becomes available, Climate TRACE will update its emissions totals (potentially including historical estimates) to reflect new data inputs, methodologies, and revisions.

With the addition of October 2025 data, the Climate TRACE database is now updated to version V5.2.0. This release expands asset coverage to include 245 additional power plants (globally) and 2,287 additional cattle operations (all in Japan). It includes non-greenhouse gas emissions for petrochemical steam cracking facilities in Asia Pacific and the Middle East. The waste sector has updated modeling for its landfill emissions: emissions are now modeled natively for each month, where previously, annual estimates were disaggregated into monthly estimates. The release also includes data fixes within transportation and waste sectors.

A detailed description of data updates is available in our changelog here.

To learn more about what is included in our monthly data releases and for frequently asked questions, click here.

All methodologies for Climate TRACE data estimates are available to view and download here.

For any further technical questions about data updates, please contact: coalition@ClimateTRACE.org.

To sign up for monthly updates from Climate TRACE, click here.

Emissions data for November 2025 are scheduled for release on January 29, 2026.

About Climate TRACE

The Climate TRACE coalition was formed by a group of AI specialists, data scientists, researchers, and nongovernmental organizations. Current members include Carbon Yield; Carnegie Mellon University's CREATE Lab; CTrees; Duke University's Nicholas Institute for Energy, Environment & Sustainability; Earth Genome; Former Vice President Al Gore; Global Energy Monitor; Global Fishing Watch/emLab; Johns Hopkins University Applied Physics Lab; OceanMind; RMI; TransitionZero; and WattTime. Climate TRACE is also supported by more than 100 other contributing organizations and researchers, including key data and analysis contributors: Arboretica, Michigan State University, Ode Partners, Open Supply Hub, Saint Louis University's Remote Sensing Lab, and University of Malaysia Terengganu. For more information about the coalition and a list of contributors, click here.

Media Contacts

Fae Jencks and Nikki Arnone for Climate TRACE media@climatetrace.org

This analysis and news roundup come from the Canary Media Weekly newsletter. Sign up to get it every Friday.

President Donald Trump’s sweeping freeze on offshore wind construction is starting to hurt his own party’s energy ambitions.

Just days before Christmas, the Trump administration halted work on all five large-scale offshore wind farms under construction in the U.S, citing unspecified national security concerns. The order may have come as a shock to the project developers, who received letters from the Interior Department only after Fox News publicly reported on the move, as Canary Media’s Clare Fieseler reported at the time.

All but one of the targeted developers have since sued the Trump administration. Danish developer Ørsted filed two separate suits over pauses to its nearly complete Revolution Wind — which the Interior already halted for a month last fall — and to Sunrise Wind. In another lawsuit, Equinor warned that the freeze would result in the “likely termination” of its Empire Wind project off New York, which also suffered a monthlong stop-work order last spring. And Dominion Energy is asking a judge to let construction resume on the utility’s Virginia project, once considered safe because it had the backing of the state’s outgoing Republican governor.

The halts are also sparking backlash on Capitol Hill that could derail some of the White House’s other energy plans. In the weeks leading up to the holidays, Congress had taken up what seemed like the millionth round of negotiations to reform energy-project permitting. Reforms are essential to Republicans’ goal of speeding fossil-fuel construction, and this time around, they’d actually made progress with the House’s passage of the SPEED Act, which had support from a handful of Democrats.

That bill requires 60 votes to clear the Senate, but with Republicans holding just 53 seats, it would need significant Democratic support. That won’t happen while the Interior’s stop-work order remains in place, two high-ranking Senate Democrats say.

“The illegal attacks on fully permitted renewable energy projects must be reversed if there is to be any chance that permitting talks resume,” Sens. Sheldon Whitehouse (D-R.I.) and Martin Heinrich (D-N.M.) said in a late December statement calling out the offshore wind halts. “There is no path to permitting reform if this administration refuses to follow the law.”

Congress reconvened this week, but Whitehouse affirmed that permitting talks won’t go anywhere until offshore wind construction is free to proceed.

Venezuela is dominating the energy discussion

While the Trump administration used allegations of narcoterrorism to justify its invasion of Venezuela and seizure of leader Nicolás Maduro, pretty much every conversation since has revolved around the country’s oil resources. In his first news conference after Maduro’s capture, President Donald Trump said the U.S. would “run” Venezuela and control its oil production, and he has been pressuring American oil companies to reinvest in the South American nation.

But it’s not just oil that the White House is eyeing. An administration official told Latitude Media that Trump and the private sector may also target Venezuela’s critical mineral resources, though experts warn that little reliable data exists on those deposits and that the country’s mining sectors are in disarray.

More delayed coal-plant retirements

The U.S Department of Energy issued a wave of orders in the waning days of 2025 to keep coal power plants running past their retirement dates. The first targeted a plant in Centralia, Washington, which its owner had been planning to close since 2011. Next up came orders to keep two Indiana coal plants open until at least late March. And just before year’s end came another, this one targeting Unit 1 at Colorado’s Craig power plant.

Both the Craig facility and one of the units in Indiana have been out of commission due to mechanical failures since earlier in 2025, meaning their owners will now have to shoulder potentially huge repair costs to comply with the federal mandate, Canary Media’s Jeff St. John reports.

And the U.S. EPA may soon throw another lifeline to coal power. The agency plans to let 11 plants dump toxic coal ash into unlined pits years after current federal rules allow, Canary Media’s Kari Lydersen reports. Without the extension, those plants would likely shutter.

A just transition? As the European Union shifts off coal, advocates and leaders are working to ensure Poland’s powerhouse mining region isn’t left behind. (Canary Media)

It’s electrifying: The rising cost of natural gas and growing popularity of heat pumps and induction cooking indicate a bright future ahead for building electrification in the U.S. (Canary Media)

State of the emergency: In the year since Trump declared a national emergency on energy, experts say an actual electricity-supply crisis has emerged, and the White House is discouraging renewable energy development that could help solve it. (Canary Media)

A new EV champion: Tesla’s sales fell year-over-year in 2025, finishing at 1.64 million deliveries, putting the company’s sales totals behind emerging Chinese company BYD, which sold 2.26 million EVs. (AFP)

Back from the dead: Nearly obsolete fossil-fuel-fired peaker plants are being forced back into service thanks to rising electricity demand from AI data centers. (Reuters)

Solar’s bigger in Texas: Data shows that solar arrays provided more power to Texas’ standalone grid in 2025 than did coal-fired power plants, marking the first time that has happened. (Houston Chronicle)

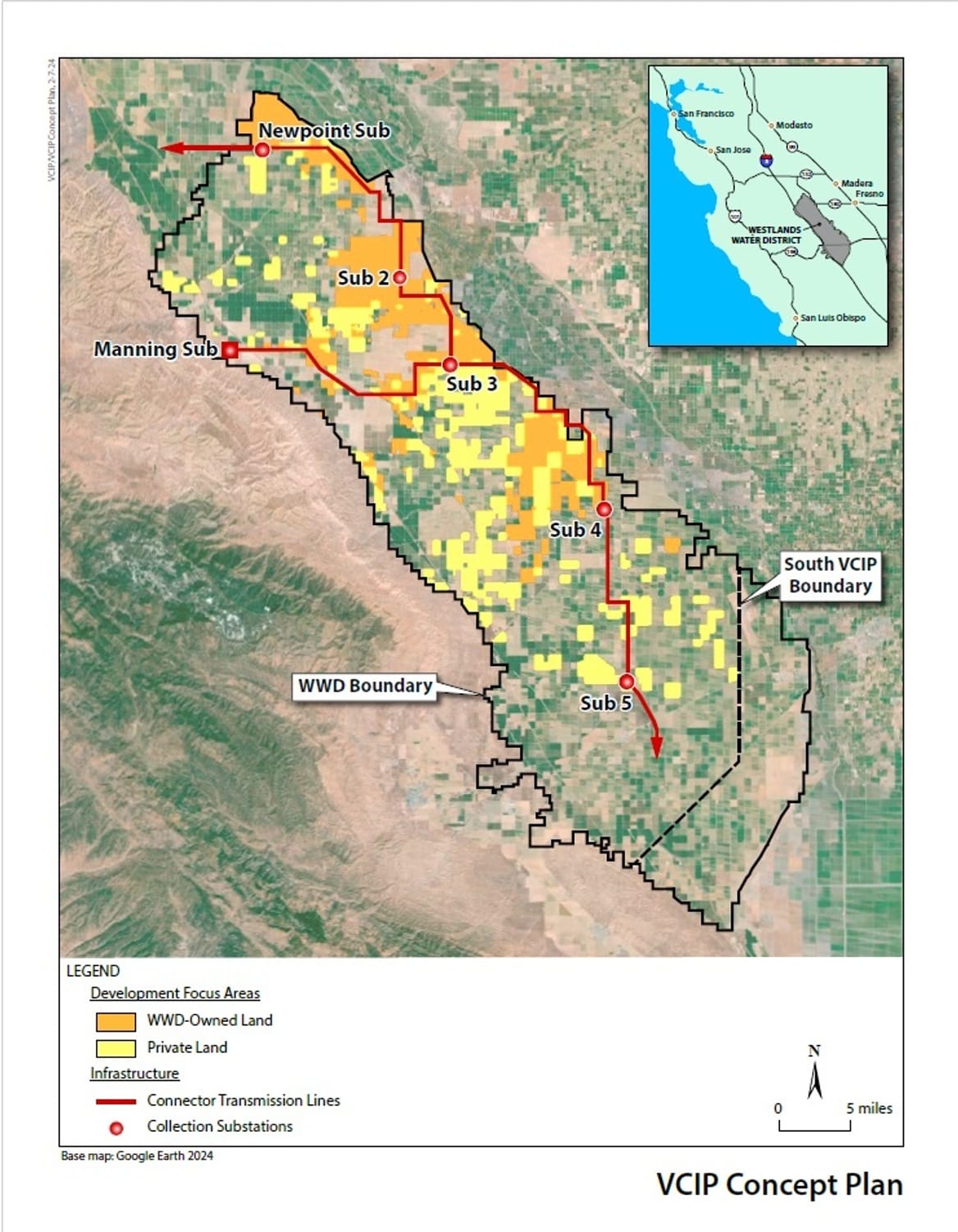

Out in the fertile yet water-constrained farmlands of California’s western Central Valley, a massive solar, battery, and power grid project that could provide a quarter of the state’s clean energy needs by 2035 has taken a critical step forward.

In December, the board of directors of the Westlands Water District, the agency that manages water delivery to more than 600,000 acres in California’s agricultural heartland, approved the Valley Clean Infrastructure Plan. VCIP calls for building up to 21 gigawatts of solar energy and an equivalent amount of battery storage across up to 136,000 acres, along with a series of high-voltage transmission lines to connect the electricity generated to the state’s grid.

That would be the largest solar and battery project in the country, and it will take up to a decade to be completed. But Patrick Mealoy, a partner and chief operating officer of Golden State Clean Energy, the company developing the master plan in partnership with the district, said it’s expected to move quickly, with the first construction work potentially happening within the next two years.

Golden State Clean Energy will carry out only a small part of the project, Mealoy said. It will mostly seek third-party solar and battery developers, with individual installations ranging in size from 100 to 1,150 megawatts.

Mealoy, a 30-year solar veteran, codeveloped Westlands Solar Park, the first major solar farm in the district. When fully completed, that project will be one of the largest in the Central Valley and produce 2.7 gigawatts — a fraction of VCIP’s scope.

The VCIP is designed to manage the multiple challenges that can stymie piecemeal solar and battery projects, such as winning environmental approvals, securing buy-in from landowners and communities, and interconnecting to the state’s congested transmission grid, Mealoy said.

“We’re doing the transmission studies, the environmental impact studies, and outreach to communities, all at the same time, to make sure there are no showstoppers.”

The VCIP is as much about preserving the region’s agriculture industry as it is about generating clean electrons, said Allison Febbo, the district’s general manager. That’s because the plan will allow the district’s more than 700 growers to redirect increasingly limited water supplies from land slated for clean energy development to land that remains under cultivation.

“The real benefit to us is that it gives our growers another crop to grow, which is the sun,” she said. “Our growers have this issue: ‘I have 100 acres of land but only enough water to irrigate 50 of those acres. What do I do with the remainder of those acres?’”

For decades, California’s Sacramento–San Joaquin River Delta has delivered water via the Central Valley Project’s system to irrigate the Westland Water District, the largest water district in the country. But in recent years, restrictions brought on by environmental and endangered species regulations for the delta have forced Westlands to fallow an increasing amount of farmland, expanding to more than one-third of its total acreage. And under the state’s Sustainable Groundwater Management Act, farmers will soon face stringent restrictions on how much water they can pump from the region’s long-stressed aquifers.

As more and more land has been left uncultivated, farm employment and property tax revenues have declined in the region. “The schools can’t be supported, the businesses can’t be supported,” Febbo said. “This is a way to maintain economic viability and support our communities.”

Mealoy said the VCIP could revitalize the region’s economy. “The cost of building solar is well north of $1 million per megawatt, probably closer to $1.5 million,” he said. Spread across 21 gigawatts of planned development, “that’s billions and billions of dollars that could be built on fallowed ag land, creating jobs and creating an enormous tax base for Fresno County,” which encompasses the land being set aside for development.

The economic benefits would extend beyond the region. An analysis commissioned by Golden State Clean Energy last year found that the clean energy and transmission congestion relief the plan would deliver could yield annual electricity cost savings of about $850 million and reduce the state’s power-sector carbon emissions by 15% through 2050.

The plan will also help reduce the grid congestion that’s created yearslong interconnection delays for large-scale solar and battery projects throughout the state, Mealoy said. In 2024, state lawmakers passed Assembly Bill 2661, a law that allows the Westlands Water District to develop its own transmission grid to get solar to market.

The project’s transmission infrastructure will be constructed under a project labor agreement using 100% union labor. That has won it the backing of the International Brotherhood of Electrical Workers Local 1245, which represents workers at Pacific Gas & Electric, the state’s largest utility.

Westland Water District’s approval of VCIP’s programmatic environmental impact report last month will allow the next big phases of the project to move ahead, Febbo said.

“With this master-planned approach, we’ll have one set of guidance, one set of rules. We’ll be able to handle how land is managed, how pests are managed, dust control — all of those things can be dealt with on a large scale.”

The project should deliver other benefits to the surrounding communities as well. Westlands Water District is bound by state law to develop community benefits agreements to provide funding for job training, environmental remediation, economic development, and other community needs for the roughly 15,000 people living nearby.

Those residents don’t want energy extraction to come at their expense, said José Antonio Ramírez, city manager of the town of Livingston and acting director of Rural Communities Rising, a newly formed collaborative of unincorporated communities. An earlier endeavor, the Darden Clean Energy Project, to be built on land to be purchased from Westlands Water District, has been criticized for having an inadequate community benefits plan.

Febbo said the district is “committed to a community benefit program, so tax revenues and other revenues will be spent on the communities that need it,” but that this work has only just begun.

Ramírez said his group is pressing for the unincorporated communities it represents to have a say in how that plan is shaped. “A lot of people out here are just making ends meet on a day-by-day scenario,” he said. “I don’t think our communities know the opportunities before them — and that these opportunities can go south if they don’t speak for themselves.”

A federal judge has ruled that Ørsted can resume the construction of its nearly complete, 704-megawatt Revolution Wind project off the coast of Rhode Island.

The decision on Monday comes after the Trump administration issued stop-work orders to all five of the offshore wind projects under development in the U.S. in late December, the culmination of President Donald Trump’s yearlong war against the renewable energy source.

Revolution Wind, a $6.2 billion project that is nearly 90% complete, was hit with an earlier federal stop-work order in August from the Bureau of Ocean Energy Management, a division of the Interior Department. A federal judge ruled in favor of Ørsted in September, allowing the project to move forward until December’s order, which cited unspecified issues of “national security.”

On Monday, the Danish developer said it will “resume construction work as soon as possible” while its complaint against the Trump administration is heard by the courts.

Judge Royce Lamberth of the U.S. District Court for the District of Columbia, who issued the injunction, said from the bench on Monday that the bureau’s August suspension order was “the height of arbitrary and capricious” and that the December order’s vague claims of national security risks did “not constitute a sufficient explanation for the bureau’s decision to entirely stop work on the Revolution Wind project.” He noted that the government’s argument for halting construction was “unreasonable and seemingly unjustified.”

Each offshore wind project has been repeatedly vetted by the Department of Defense since being proposed, and developers said they were blindsided by the Trump administration’s latest security concerns.

Ørsted and two other offshore-wind developers, Equinor and Dominion Energy Virginia, all sued to vacate the Trump administration’s 90-day construction freeze from December. Ørsted’s court hearing was the first, and judges are set to consider the fate of the other in-progress offshore wind projects this week.

On Wednesday, a court could decide on Equinor’s 810-MW Empire Wind project, which also previously received and defeated a stop-work order. A hearing for Dominion Energy’s massive 2.6-gigawatt Coastal Virginia Offshore Wind project is scheduled for Friday. In addition to energy developers, the states of Connecticut, New York, and Rhode Island have all sued to get the projects going again.

The stakes are high: In total, the five offshore wind farms affected by the Trump administration’s December order would bring nearly 6 GW of capacity to the grid, or enough to power roughly 2.5 million homes across the East Coast.

The U.S. can’t afford to lose any of these projects. Energy demand is climbing across the nation, causing household utility bills to soar. More power plants are needed to keep bills from rising even further — especially in regions swamped with power-hungry data centers, like Virginia.

In addition, grid operators have been banking on the arrival of these large-scale offshore wind projects, several of which are more than halfway complete. In August, ISO-New England issued an unprecedented warning that the Trump administration’s first pause on Revolution Wind created “unpredictable risks” that could “undermine the power grid’s reliability and the region’s economy now and in the future.”

At least one project could be abandoned imminently. Equinor, which already lost nearly $1 billion because of the first stop-work order on Empire Wind, says the beleaguered project faces “likely termination” if it can’t continue work by this Friday.

Meanwhile, industry groups applauded Monday’s decision.

Kat Burnham, the New England policy lead for Advanced Energy United, said the D.C. court “rightly saw through a politically motivated stop-work order that would have caused real harm: driving up costs, delaying power for Rhode Island and Connecticut, and putting good-paying jobs at risk.” In a statement, she said the decision is “good news for workers, ratepayers, and anyone who recognizes the need for a fair energy market.”

The latest skirmish over offshore wind comes after a year of assault from the Trump administration. Trump has gummed up the build-out of onshore wind and solar power, too — but no energy source has been targeted like offshore wind.

The impact of Trump’s war on the sector is profound.

When he was reelected in 2024, BloombergNEF expected 39 GW of offshore wind capacity to come online in America by 2035. The research group hedged that number to 21.5 GW if Trump managed to repeal wind tax credits during his term. He did. As of October, BNEF expected just 6 GW to get online by 2035 — a number that will be even lower if any of the in-progress projects buckle under the weight of the latest order.

Sergio Mendez was tired of earning a living by working security in nightclubs. So the 22-year-old resident of Chicago’s Southwest Side decided to make a big change, enrolling in a 10-week program that promised to teach him the fundamental skills needed to pursue a career in the solar industry.

“I was just dealing with a lot of drunk people. I wanted to get out of it,” Mendez said of his former job. Now he envisions a future as a solar salesperson or installer. In late December, he graduated alongside six other young adults enrolled in the course, run by Elevate, a national clean-energy nonprofit based in Chicago.

The cohort is stepping into an industry that experts say is going strong in Illinois, even as the Trump administration cancels clean-energy tax credits, claws back funding for pollution-reducing projects, and enacts other policies that make it harder to build renewable energy.

Illinois has emerged as a solar leader in recent years, thanks in large part to its robust incentives and its mandates that utilities get an increasing amount of electricity from renewables. In 2024, the state ranked fourth nationwide in terms of new solar capacity, with over 2,800 megawatts installed, and it added another 815 megawatts in the first three quarters of 2025, according to a December report by consultancy Wood Mackenzie and the Solar Energy Industries Association.

The industry’s momentum translates to lots of employment opportunities: The Solar Energy Industries Association counted almost 6,000 solar jobs in Illinois in 2025, and it projects that the state will add close to another 15,000 megawatts of solar over the next five years.

“With energy demand growing — some would say, out of control — solar is the fastest [generation source] to deploy,” said J.D. Smith, a spokesperson for the Wisconsin-based solar installer Arch Electric. “From a technical standpoint, if you’re trying to power the grid, [solar] is such a good decision. You can get it cheap and fast, and it’s repeatable.”

Companies expanding to meet that demand are eager to snap up graduates of workforce development programs.

In the past year, Arch — one of the employers at a December job fair for Mendez and his peers — has hired 14 graduates of training programs run by Elevate and other Chicago-area nonprofits. Seven of those individuals are already in apprenticeships to become certified electricians.

“If you know at least 50% of the people you hire from these organizations will want to be an apprentice and invest in their future with your organization, that makes it a business no-brainer,” Smith said.

Solar companies also rely on training programs to produce qualified candidates from what the state has defined as “equity” communities, he explained. Under Illinois’ 2021 clean-energy law, firms can access incentives for hiring individuals from these areas, which face disproportionate amounts of pollution and have historically been excluded from economic opportunities.

“There is an enormous demand for these programs,” Smith said. “We will take everyone we can get who is willing to invest their time and learn.”

The course that Mendez graduated from marks Elevate’s first solar training aimed specifically at adults between the ages of 18 and 24.

Many of the participants, including Mendez, are alumni of the Academy for Global Citizenship, a K–8 charter school on Chicago’s Southwest Side that hosted the course in two geodesic domes built specifically for the program. The school’s campus boasts both ground-mounted and rooftop solar panels, as well as a geothermal heating and cooling system.

“When you’re around it since you’re young, it’s just normal,” Mendez said of solar.

Solar training in session on Dec. 4, 2025, inside one of the geodesic domes at Chicago’s Academy for Global Citizenship (Kari Lydersen/Canary Media)

Over the course of Elevate’s training, students learned about everything from the basics of electricity to solar system installation. They got hands-on practice with panels and wiring and took a field trip to see one of Illinois’ many community solar arrays. And they prepared for the North American Board of Certified Energy Practitioners exam; a certification like the one issued by NABCEP is required to install solar on buildings in most states, including Illinois.

“We see how to set up a solar panel system, how all the parts work, how we make sure not to blow anyone up,” said student Josh Paz, age 23, another alumnus of the charter school. Before enrolling in Elevate’s training, he had worked in retail stores, in warehouses, and as a landscaper.

“I’ve always liked to work with my hands, so it’s pretty fun,” he said of solar. “And we’re building a cleaner future. America’s a little behind the rest of the world, but it’s good to see solar growing exponentially.”

Other graduates of the Elevate program are similarly bullish about building a career in clean energy — and using it to address societal injustices in Chicago and beyond.

“You see the discrimination, the amount of residential areas near power plants, all Black and brown people,” said 21-year-old Matthias Hunter. “The race for renewable energy in America is going to be a challenge, especially with this administration. But there’s light at the end of the tunnel. This is the future. It’s not optional.”

North Carolina’s predominant utility is backing away from a long-held plan to double the size of its largest pumped storage hydropower plant — just as data centers and other voracious energy users threaten to stretch power supplies to their limit.

The reversal was tucked away in Duke Energy’s latest long-term blueprint, which was filed in October and will be evaluated and finalized by regulators this year. Clean energy advocates had expected to fight that blueprint on familiar fronts — from its inclusion of new gas-fired power plants to its complete lack of near-term wind energy — but they were surprised by the backpedaling on the Bad Creek storage facility, located just over the border in South Carolina.

“Duke put this forward as something they were going to do, and everybody agreed,” said David Neal, senior attorney at the Southern Environmental Law Center. “To take out the one thing that everybody agreed on, without any announcement, without any fanfare,” he said, “is just baffling to me.”

Pumped hydro is a uniquely useful form of carbon-free electricity. It’s available on demand and can dispatch power over a much longer period than a lithium-ion battery can. It’s also rare: Construction of new pumped hydro facilities in the U.S. has stagnated for decades.

Duke’s original Bad Creek expansion plan would have catapulted the company to become the nation’s leader in pumped hydro. Now, advocates fear its about-face will undermine the state’s zero-carbon law by opening the door for a fleet of new gas plants instead.

Hydropower is one of the oldest forms of electricity generation — and it’s how Duke Energy, then called the Catawba Power Company, got its start in the early 1900s. A trio of entrepreneurs, led by James B. Duke, built a series of dams and lakes along the Catawba River, fostering the growth of mills and other industries that helped diversify the region’s economy.

Today, traditional hydropower makes up a tiny fraction of Duke-owned power capacity, with nearly 1.3 gigawatts spread across 25 different sites in the Carolinas. There’s no push to change that number, as conservation groups focus on removing the thousands of other dams in North Carolina that provide little to no upside to outweigh the ecological damage they cause.

Pumped storage hydropower — like that at Bad Creek — is a related but different beast. Two bodies of water at different elevations are connected with reversible turbines, producing or storing electricity, depending on what the grid needs.

“Let’s say it’s a spring day, a sunny day, a lot of solar on the grid, but not a lot of demand. You just bring that water uphill,” to store in the upper reservoir, Neal explained. “When you’re in a peak period, you run the water back downhill to generate electricity. It’s a very efficient, clean way of having storage.”

Duke launched its first pumped storage project in 1975 after building a dam between what is now Lake Jocassee and Lake Keowee below it. On the South Carolina side of the Blue Ridge Mountains, the four reversible turbines are slated to operate for at least another two decades.

The Bad Creek complex followed in 1991. The upper reservoir sits at an elevation of 2,310 feet, and Lake Jocassee, more than 1,000 feet below, serves as the lower reservoir. They’re linked by an underground concrete tunnel and a four-turbine powerhouse, capable of supplying enough electricity to power 1 million homes.

Totaling over 2.4 gigawatts, the Jocassee and Bad Creek plants function as massive batteries, and are the largest source of energy storage anywhere on Duke’s six-state electric system. According to the U.S. Energy Information Administration, only two states, Virginia and California, have more pumped storage capacity.

Duke recently upgraded the existing Bad Creek facility, increasing its capacity to nearly 1.7 gigawatts. But the utility has also long envisioned drilling a new tunnel and adding another four-turbine powerhouse at the site, adding another roughly 1.8 gigawatts. Doing so would help the company zero out its carbon emissions by midcentury, as required by state law.

In 2022, the company offered four pathways to limit its pollution; all included the expansion, dubbed Bad Creek II, by 2034. The additional Bad Creek capacity was also cemented in a compromise Duke struck with stakeholders to help get its last carbon-reduction plan approved. Regulators on the North Carolina Utilities Commission blessed the deal, directing the company to pursue “all reasonable development activities” to put Bad Creek II in place.

But in October, when Duke submitted its 2026 carbon proposal, Bad Creek II was barely mentioned. Among 10 different pathways the company charted toward climate neutrality, only one included the new pumped storage capacity.

Earlier in 2025, Duke had quietly removed Bad Creek II from an engineering study that evaluated the impact of new power plants on the transmission system. The removal means that the soonest Bad Creek II could come online is now 2040 — six years later than previously envisioned — but the company doesn’t recommend even that late date or pinpoint a new one.

“Notwithstanding the delayed development timeline,” Duke said in its plan, the utility remains “committed to exploring the potential for additional [pumped storage hydro] capacity at the Bad Creek II site.”

The backtracking has alarmed clean energy advocates, who point out how well pumped storage complements other sources of renewable energy. Duke’s own modeling shows that adding Bad Creek II would enable more solar, onshore wind, and batteries, while eliminating the need for over 2 gigawatts of new gas plants.

“That all seems like a really good deal, and if we could do that sooner, as Duke had committed to in the last plan, and as the commission ordered it to do,” Neal said, “we’d be on such a clear path to complying with state law and having a much more diverse portfolio.”

Duke acknowledged that Bad Creek II would lead to lower overall costs than its preferred plan through 2050. Viewed in that light, Neal said, “it seems like a really bad deal for customers for Duke to be turning its back on this project.”

In its proposal, Duke offered no specifics on the long-term cost impacts of Bad Creek II, but did say that removing it from the grid impact study showed savings of approximately $358 million in “network upgrade costs.” By punting on the project, the company also put off spending tens of millions of dollars on development activities.

Asked for more justification, beyond those up-front savings, for Duke’s bid to delay the project, spokesperson Bill Norton said via email: “More work is needed to assess whether Bad Creek II will be part of a least-cost plan for customers.”

As to whether the company might shelve the project entirely, Norton said that it “remains a potential resource in the future.” He added that Duke plans to spend enough money to qualify the expansion for time-limited 30% federal tax credits and that the potential for additional turbines is included in Duke’s relicensing application to federal regulators.

“While there is no specific timeline today for a second powerhouse,” Norton said, “our continued licensing work preserves the option for the future, and we will continue to engage our regulators on this decision.”

As the commission evaluates Duke’s long-term plans, advocates will be pushing for a green light on the Bad Creek expansion — especially as an alternative to the other, more speculative sources of firm power that the utility is banking on, like small modular reactors.

In contrast to that form of nuclear power, pumped hydro is “not a nascent technology,” said Justin Somelofske, senior regulatory counsel at the North Carolina Sustainable Energy Association. That’s why in past hearings over the utility’s plans, he noted, “it was the one resource that was not in controversy and not contested.”

“One of the biggest things that we consistently hear from the Utilities Commission is the need for more dispatchable, reliable generation,” Somelofske said. “Pumped storage satisfies that need.”

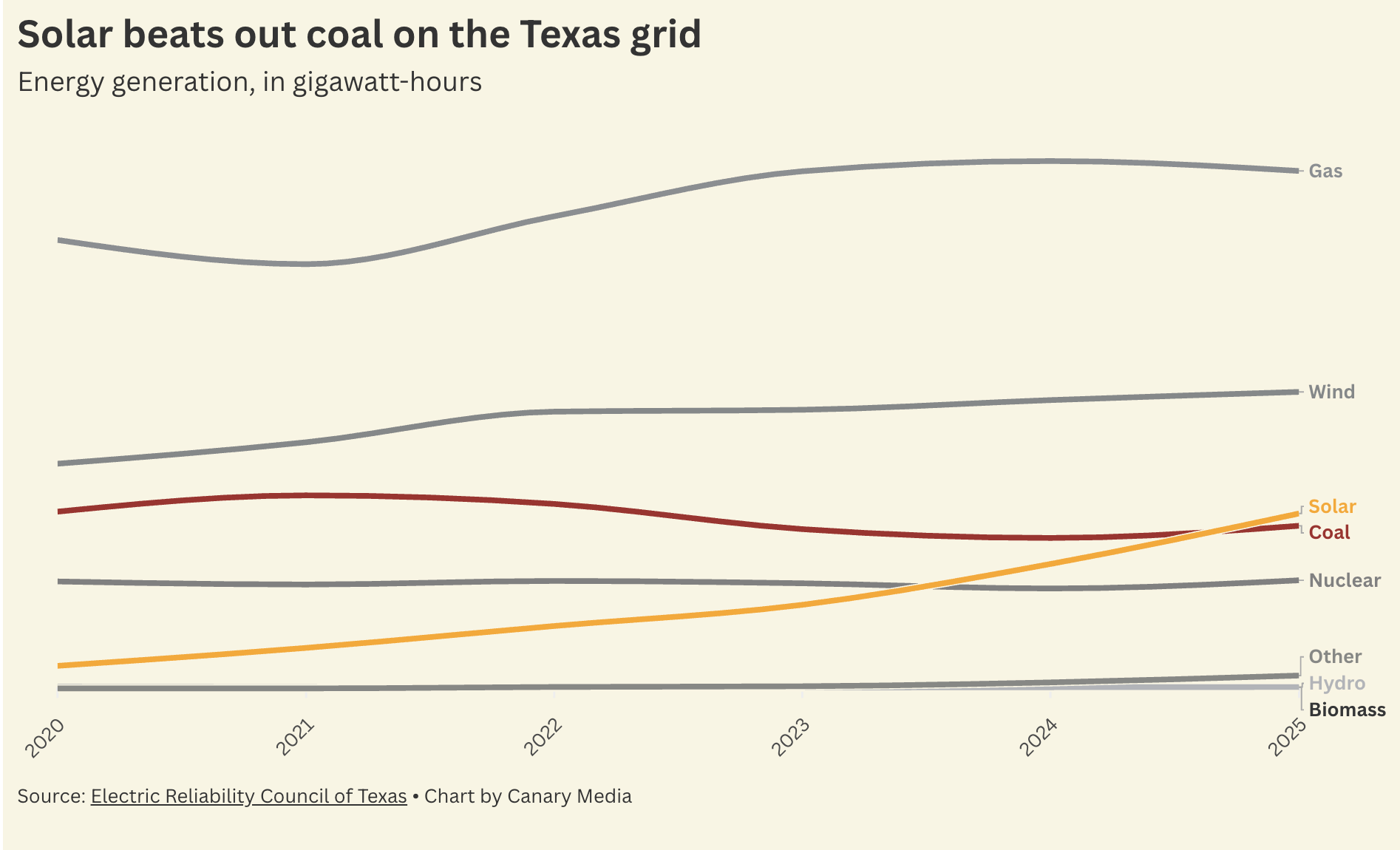

Texas just hit a huge milestone: It got more electricity from solar than it did from coal last year, a first for the second-biggest state in the country.

That’s a big shift from a few years prior. Back in 2020, the Texas grid got just 2% of its electricity from solar power and 18% from coal, according to the Electric Reliability Council of Texas, which operates the grid for the vast majority of the state. In 2025, nearly 14% of ERCOT’s electricity came from solar — and just under 13% was produced by burning coal.

Texas, long a leader on wind energy, has been building solar at a blistering pace in recent years. It’s now the state with the most utility-scale solar capacity, beating out longtime champion California for the top spot.

It makes sense that solar has taken off in Texas. Two things it has in spades are sunshine and land, and ERCOT’s competitive markets and fast interconnection processes are appealing to solar developers. In recent years, the state’s solar boom helped create one of the nation’s hottest markets for grid batteries, which in turn has strengthened the business case for installing even more solar.

Meanwhile, coal has been declining in Texas for more than a decade, knocked off balance first by a combination of fracked gas and cheap wind power.

Overall, however, fossil fuels still produce the majority of Texas’s electricity. The state got 54% of its power last year from coal and gas, with the latter fuel serving as Texas’ biggest source of electricity by a long shot.

It’s worth noting that solar beat out coal in what was a comeback year for the fossil fuel, in Texas and beyond. After two years of declines, coal generation jumped by 8% in Texas in 2025. But because solar grew so fast — by a staggering 41% last year — the clean-energy source eclipsed coal anyway.

Not everyone in Texas is happy about the rising tide of solar.

Some state Republicans have tried and failed, several times now, to limit the growth of clean energy. Instead, they’d like to see the construction of natural gas plants to meet the state’s surging electricity demand. But Texas faces the same reality as the rest of the country: Solar and storage are simply too cheap and easy to deny.

As the Trump administration wages a high-profile attack on the nation’s offshore wind farms, it has also been quietly fighting a brutal battle with renewable energy projects on land.

Since President Donald Trump took office nearly a year ago, his administration has announced at least two dozen policy and regulatory actions aimed at hindering the build-out of wind and solar projects, including rescinding federal tax credits, withdrawing grants and loans, and freezing permitting approvals. Yet one measure in particular has had an outsize chilling effect — and is facing a new legal challenge from clean energy groups.

Last summer, the U.S. Interior Department announced that all decisions related to wind and solar projects would require an “elevated review” by Secretary Doug Burgum, saying this would end the Biden administration’s “preferential treatment” for renewables. In a July memo, the agency listed nearly 70 types of permits and other actions that now need Burgum’s personal sign-off, adding cost and time and creating significant anxiety for developers, experts say.

Over 22 gigawatts of utility-scale wind and solar projects on public lands have been canceled or are held up as a result of the order, according to Wood Mackenzie data and the Interior’s Bureau of Land Management website. That’s enough capacity to power roughly 16.5 million U.S. homes — a significant amount at any point, but especially when the country is clamoring for more low-cost electricity as energy demand and utility bills soar.

“We’re seeing electricity costs go up all around the country, and the cheapest electrons that we can put into the supply side of that equation are all stuck on Secretary Burgum’s desk,” Sen. Martin Heinrich (D-N.M.) told Canary Media.

Solar represents the bulk of that figure, with 18 GW of facilities scrapped or considered inactive as of December, by Wood Mackenzie’s count. Nearly 90% of those projects also included energy storage, given that many were slated for desert regions in the Southwest, said Kaitlin Fung, a research analyst for the consultancy.

“It’s created a choke point,” Fung said of Interior’s memo. She noted that the Bureau of Land Management has advanced permits for only one renewable energy project since July: the 700-megawatt Libra Solar facility in Nevada. Meanwhile, federal oil and gas permits have surged in the first year of Trump’s term.

Many other projects remain stuck in permitting limbo as developers await the approvals they need — from quick consultations to complex reviews — in order to secure financing and begin building their large-scale renewable energy installations. That’s true for wind and solar farms on private and state lands as well, since those projects might require federal approval for things like wildlife and waterway impacts.

The holdups are occurring as the United States teeters on the edge of an electricity crisis. Demand is climbing across the nation, causing household utility bills to soar, and more power plants are needed to satisfy the surge in AI data centers, factories, and electrified cars and buildings. Large-scale solar and onshore wind projects are among the fastest and lowest-cost ways to add power to the grid — faster than Trump’s preferred path of building new gas-fired power plants or restarting shuttered nuclear reactors.

Heinrich, the ranking member of the U.S. Senate Energy and Natural Resources Committee, cited the gigawatts of stalled projects in a Senate floor speech earlier this month. He and other Democratic leaders have said that any efforts to pass bipartisan legislation on energy permitting reform are “dead in the water” so long as the Trump administration continues to block development of onshore wind and solar and cancel fully permitted offshore wind farms.

“The concern is that we put a balanced legislative package together that gives certainty to both traditional [oil and gas] energy and renewables — but if this administration is going to say yes to all of the fossil projects and create a de facto moratorium on all of the renewable and storage projects, then we haven’t accomplished anything,” Heinrich said by phone.

In recent weeks, a coalition of clean energy organizations sued to overturn the July memo and other actions from Interior and the U.S. Army Corps of Engineers, which issues permits for energy projects near navigable waters. Both the Army Corps and Interior say they’re prioritizing projects that generate the most energy per acre, a measure that favors coal, oil, and gas and undercuts renewables — and which has its roots in fossil-fuel industry misinformation.

Such actions “arbitrarily and discriminatorily place wind and solar technologies into a second-class status compared to other energy sources,” the groups said in a statement this week. “The Trump administration has choked private developers’ ability to build new and urgently needed energy projects across the nation.”

For solar and storage in particular, nearly 520 proposed projects totaling 117 GW of capacity have yet to receive all the necessary federal, state, and local permits, which puts them at risk of being delayed by the Trump administration, according to the Solar Energy Industries Association. The projects represent half of the country’s new planned power capacity.

Many developers are simply receiving radio silence from agencies whose approval or advice they need, said Ben Norris, SEIA’s vice president of regulatory affairs, who likened the agencies’ actions to a “blockade on solar permits.” Fung noted one mundane but significant effect of Interior’s memo: Wind and solar developers are now excluded from using an online government planning tool that helps streamline environmental reviews, a move that creates additional costs and complexity for companies.

The delays come as developers are racing to qualify for federal tax credits under the newly shortened timelines. Wind and solar installations must either start construction this summer or be operating by the end of 2027 to access incentives. “Time is really of the essence for many of these projects,” Norris said. In the absence of Congress passing a permitting-reform bill, he added, the Trump administration could simply remove many of the roadblocks it created by revoking its memos and other actions.

“If they were really serious about affordability and addressing power bills, they could take these steps today,” he said.

This analysis and news roundup come from the Canary Media Weekly newsletter. Sign up to get it every Friday.

The Trump administration had a tough week in court, starting with a Monday ruling that could pave the way for states and cities to unlock billions of dollars in revoked clean-energy grants.

Back in October, the Trump administration terminated a massive $7.6 billion in federal funding for climate and clean energy projects. There was a clear pattern to the clawback: Nearly every grant would’ve benefitted a state that voted for Democratic nominee Kamala Harris in the 2024 presidential election.

And the White House wasn’t exactly hiding its politically driven motivations. In a post on X announcing the rollback, Russ Vought, director of the Office of Management and Budget, referred to the revoked grants as “Green New Scam funding to fuel the Left’s climate agenda.”

St. Paul, Minnesota, was among the cities, states, and organizations that lost funding — $560,844 for expanding EV charging, to be exact. So the city partnered with a handful of environmental groups to fight back in a lawsuit that resulted in a big admission from the Trump administration. In a December filing, Justice Department lawyers said they would not contest the assertion that a state’s votes for Democrats influenced the termination decisions.

U.S. District Judge Amit Mehta called out that assertion in his ruling, writing that “defendants freely admit that they made grant-termination decisions primarily — if not exclusively — based on whether the awardee resided in a state whose citizens voted for President Trump in 2024.”

While Mehta ordered the Trump administration to release about $28 million to St. Paul and its fellow plaintiffs, billions of dollars’ worth of other grants remain frozen. But one former U.S. Energy Department official told Latitude Media the win lays a clear path for other awardees to sue: “If the administration doesn’t reverse all of the terminations, then they should prepare for hundreds of additional similar lawsuits.”

Three big wins for offshore wind

Offshore wind is beginning to move and groove again after the Trump administration’s December order that the nation’s five in-progress wind farms halt construction.

On Monday, a federal judge allowed Revolution Wind to resume work off the coast of Rhode Island. Equinor won a similar ruling on Thursday to keep building its Empire Wind project near New York. And Friday brought a third victory, with a judge letting Dominion Energy’s Coastal Virginia Offshore Wind forge ahead. There’s no word yet on whether the two other affected installations can restart construction.

The federal stop-work order has put billions of dollars, thousands of jobs, and gigawatts of much-needed power in jeopardy. Grid operator PJM Interconnection intervened in the Virginia project’s lawsuit late last week, saying its delay would threaten power supplies in the region. Equinor had said it may need to cancel Empire Wind altogether if it couldn’t restart work this week.

Meanwhile, Revolution Wind developer Ørsted said it’s not taking the court win for granted, and will hurry to install its final seven turbines before more setbacks arise.

A disappointing rebound in carbon emissions

After two years of declines, U.S. carbon emissions rose in 2025, according to a new Rhodium Group report. The 2.4% year-over-year increase is the third largest the U.S. has seen in the past decade, and shows that while the country is still heading toward decarbonization, major hurdles stand in its way.

Part of the increase can be chalked up to statistical “noise,” including an extra-cold winter that increased buildings’ space-heating needs, Rhodium Group analyst Michael Gaffney told Canary Media’s Julian Spector. But electricity usage also surged, largely thanks to data centers and other large power consumers, and carbon-spewing coal plants ramped up to meet that demand.

“This year is a bit of a warning sign on the power sector,” Gaffney said.“With growing demand, if we continue meeting it with the dirtiest of the fossil generators that currently exist, that’s going to increase emissions.”

Coal plans confirmed: U.S. Energy Secretary Chris Wright says the Trump administration intends to keep many more coal plants open past their scheduled closing dates, which could saddle utility customers with excessive costs. (New York Times)

Dismissing public health: The U.S. EPA plans to stop calculating how much money the country saves in avoided health care costs and deaths when it curbs fine particulate matter and ozone pollutants. (CNBC)

Make way for clean energy: California’s Westlands Water District approves a plan to build up to 21 GW of solar generation and another 21 GW of battery storage on water-parched land, which would be the largest solar and battery project in the country. (Canary Media)

You can pay your own way: New York Gov. Kathy Hochul (D) announces a plan to make sure data center power demand doesn’t raise costs for residents — a concept President Donald Trump also voiced support for in a social media post this week. (Axios, Washington Post)

Steel status report: 2025 saw major U.S. steel companies backing away from decarbonization investments and recommitting to coal-fired blast furnaces, but global demand for green steel is still on track to grow in the new year. (Canary Media)

The state of solar: Illinois’ solar industry is thriving despite federal obstacles, creating jobs that workforce training programs are preparing young people to fill. (Canary Media)

The tale of the clean energy transition is long and winding — and unfortunately, we here at Canary Media don’t have a crystal ball to tell you exactly what’s coming next.

But we can let you in on the big storylines our reporters and editors are keeping a close eye on as we head into 2026. Here’s the list, covering everything from companies on the cusp of tech breakthroughs to policy debates that are hitting a boiling point.

Things are getting messy. President Donald Trump has gutted the only significant decarbonization law the U.S. ever managed to pass. Blue-state governors are backsliding on clean energy goals and easing up on fossil fuels under the cover of affordability. Oil and gas companies have dropped the pretense of caring about climate. ESG is dead. The “climate hawk” is dead. The words “pragmatism” and “realism” have become as inescapable in climate policy discourse as reminders of planetary warming are in the weather reports.

Yes, the climate conversation has changed dramatically over the last year, at least in the Western world. But the techno-economic trends that are driving decarbonization forward have not. Clean energy — mostly solar — is still being built at a blistering pace. EVs are beginning to run gas cars off the road. China’s emissions could be starting to decline. The world is on track for far less warming than it was when the Paris Agreement was signed a decade ago, and we’re still in the early innings of clean energy deployment.

In 2026, I’ll be watching this dissonance between decarbonization vibes and reality. Will politicians, companies, and others grow increasingly quiet on climate, all while the clean energy revolution speaks louder and louder? — Dan McCarthy, senior editor

What do you do when you can’t build actual power plants fast enough to keep the lights on and the air conditioners humming? You turn to virtual power plants.

Utilities and regulators have in recent years begun to embrace these networks of rooftop solar panels, backup batteries, plugged-in electric vehicles, smart thermostats, remote-controllable water heaters, and other “distributed energy resources” in homes and businesses. By controlling this equipment to lower electricity demand and provide energy to the grid, utilities can replicate much of the value of a traditional, centralized power plant.

Now, the AI boom is forcing decision-makers to take VPPs even more seriously. Gigawatts of planned data centers are pushing up already high and rising utility bills. Equipment shortages are making it nearly impossible to quickly build gas plants, while interconnection bottlenecks are preventing lots of utility-scale renewables from coming online. And the risks of overbuilding to serve what could end up being an AI bubble are rising.

VPPs could help solve all those problems by enlisting energy tech that people are already buying. What I’m eyeing in 2026 is whether utilities, grid operators, and the state and federal regulators overseeing them put their weight behind the VPP build-out. — Jeff St. John, chief reporter and policy specialist

2026 is a threshold year for the American nuclear industry as it strives to lay the foundation for an unprecedented scale-up of atomic energy in the U.S. — quadrupling nuclear generating capacity by 2050, as per President Trump’s executive order.

The operators of the Palisades and Three Mile Island plants are pledging 2026 and 2027 restart dates for those mothballed reactors. Additional Trump executive orders are aiming for three advanced nuclear startups to achieve criticality in 2026. (One reactor has already staked that claim.)

Over the coming months, I’ll be tracking whether the industry keeps its bold promise of power-plant restarts and advanced reactor development. We’ll be reporting on the crop of nuclear startups and whether they can deliver on their audacious claims. And we’ll be watching whether the U.S. can start building nuclear reactors at scale.

If those plans are backed by sufficient capital and follow-through, they could restore some of the country’s lost atomic luster. If not, the U.S will have ceded its global nuclear leadership to China and Russia. — Eric Wesoff, executive director

Northernmost Maine has strong winds and lots of open space. But renewable energy developers have not yet managed to capitalize on these conditions to build substantial onshore wind farms, even though the idea has been floating around the state since at least 2008. Last year, Maine energy officials and regional grid operator ISO New England kick-started yet another effort to get turbines spinning up north with requests for proposals for both generation and transmission lines to carry the power south to the rest of the region.

I’ll be watching closely for a few reasons: First, the New England grid needs more power supply as the climate-conscious states it serves make moves to electrify buildings and transportation, and 1,200 megawatts of onshore wind would certainly help. Also, if the plan succeeds, it could offer valuable lessons about the economics of developing renewable energy in the face of federal hostility, which, I think we can all agree, is unlikely to abate anytime soon. — Sarah Shemkus, Northeast reporter

As voters worry about the cost-of-living crisis, all-electric new buildings could help keep mortgage payments and energy bills down.

Though exact savings depend on local energy costs, a growing number of analyses have found that all-electric new construction makes financial sense. Building a home with only an electric system is often a simpler feat than building it with both electricity and gas. In some cases, all-electric homes can save people thousands of dollars over the lifetime of super-efficient electric appliances, such as heat pumps and heat-pump water heaters. Even retrofitting an existing structure with these technologies can pay off in the long term, especially in areas with favorable electricity rates.

Yet policymakers who once pushed ambitious electrification standards have been pulling back. Los Angeles Mayor Karen Bass (D) waived her city’s requirement that new buildings be all-electric after last year’s catastrophic wildfires, then repealed it completely. In June, air-quality regulators in Southern California punted a plan that would have incentivized a gradual phasedown of gas furnaces and water heaters sold in the region. And New York Gov. Kathy Hochul (D) delayed her state’s first-in-the-nation all-electric building code, which would have taken effect on Dec. 31, 2025.

In 2026, I want to see if politicians and regulators will recognize that electrification can in fact boost affordability, especially in newly built homes. — Alison F. Takemura, staff writer

Geothermal energy startups have raised huge sums of money in recent months and years to develop next-generation technologies for harnessing Earth’s heat. But so far, the companies have delivered relatively little carbon-free electricity to the grid.

That will change this year, when Fervo Energy flips the switch on its Cape Station facility in Utah. The startup is building an “enhanced geothermal system” that uses fracking techniques to create geothermal reservoirs in hard, impermeable rocks. The first 100 megawatts (of an eventual 500 MW) are slated to go online in October, which would make Cape Station the biggest project of its kind to connect to the grid worldwide.

The development will send “a powerful signal that next-generation geothermal is moving from promise to commercial reality,” said Jeremy O’Brien of geoscience software company Seequent. “We expect this milestone to accelerate both investor interest and government support globally.”

Fervo isn’t alone in its ambitions. The company Eavor will start working this spring to expand its first-of-a-kind geothermal project in Germany, and firms like Sage Geosystems, Quaise, XGS, and Zanskar are accelerating efforts to satisfy demand for clean, around-the-clock power. I’ll be watching closely to see whether 2026 proves to be the pivotal year the industry is hoping for. — Maria Gallucci, senior reporter

Ohio, where I report from, has for years been a hotbed for dark money and a testing ground for national efforts to hinder action on climate change. State lawmakers and regulators continue to throw up obstacles to renewable energy development, while giving preference to new fossil-fueled power plants. One pending bill, for example, calls for energy permitting decisions to make sure facilities “employ affordable, reliable, and clean energy sources,” with “reliable” meaning energy that’s available at all times and “clean” defined to include natural gas. I’ll keep investigating those efforts in 2026 to hold the people in power accountable as the public struggles with rising energy costs and worsening climate change impacts.

But it’s not all bad news in the Buckeye State, as some communities rally in support of clean energy. One story I’m particularly excited to cover is a May referendum that will give voters the chance to overturn a local solar and wind ban covering most of their county — an approach that could take off elsewhere in Ohio and in other states that allow local restrictions on renewable power. — Kathiann M. Kowalski, contributing reporter based in Ohio

2026 will be the year we start seeing batteries bridge the gap between data centers’ sky-high power demand and what the U.S. grid can actually deliver.

A well-placed battery system can secure electricity for AI computing hubs in the relatively few hours each year when the grid can’t supply them. That can allow data centers to get built far sooner than if they waited for pricey and time-consuming power network upgrades.

Storage developers are reporting a frenzy of interest in such projects, but these typically are shrouded in secrecy. I recently reported on the first publicly confirmed project of this kind, which entered construction in Oregon for Aligned Data Centers and should start operating in 2026. Utility Portland General Electric will own that one and use it to guarantee power a few years earlier than it could have with conventional grid upgrades.

What I found most intriguing is that the data center developer is paying for this smart grid upgrade. This arrangement lays out a rare positive vision for the nation’s energy future: The companies that stand to make boatloads of money on data centers could fund grid upgrades that benefit everyone, as opposed to the general public subsidizing those upgrades to pad the profits of AI ventures. In the year ahead, I’ll be tracking the proliferation of batteries for data centers, and what they mean for consumers’ energy bills. — Julian Spector, senior reporter

Over the past decade, scores of Midwestern coal plants have closed, as environmental regulations kicked in and coal-fired generation became more expensive than natural gas or renewables.

Now, the tables could be turning again.

Utilities are pushing back retirement dates for coal plants as electricity-demand forecasts increase exponentially due to proposed data centers — many of which may never get built. The Trump administration is ordering plants on the brink of closure to stay open and easing up on rules around pollution from coal power. Indiana’s Republican Gov. Mike Braun issued an executive order last spring calling for coal plant “life extensions,” and Illinois experts are researching controversial “clean coal technologies,” including at a demonstration carbon-capture plant that went online in 2024.

Coal is embedded in the culture in these states, and it’s highly political, as I’ve heard many times from elected officials, grassroots activists, and coal miners. In 2026, I’ll be closely tracking how this campaign to revive coal progresses and what it means on the ground in Midwest communities where it is burned and mined. After all, coal isn’t just an increasingly expensive way to generate electricity; it’s also incredibly polluting. — Kari Lydersen, contributing reporter based in Illinois

The future of America’s offshore wind sector may well be in Canada — a country prepping its first projects and willing to share power generated from its frigid ocean breezes with U.S. states just across the border.

Thanks to President Trump’s ire, it’s likely that no new offshore wind farms will be completed in the U.S. until 2035, save for the five projects already being built, BloombergNEF predicted in early December. Even those projects aren’t guaranteed, a fact underscored by the 90-day pause on wind farm construction issued Dec. 22 by the Interior Department.

But Northeast U.S. states aren’t giving up on the renewable energy source. Massachusetts is exploring sourcing offshore wind power from Canada, with Democratic Gov. Maura Healey meeting with Nova Scotia’s premier last month to discuss partnering on energy needs. Maine also seems interested.

In 2026, I’ll be keeping a close eye on whether these deals materialize — and what they mean for North America’s offshore wind workforce and supply chain, which grew under the Biden administration and could otherwise wither away under Trump 2.0. — Clare Fieseler, reporter