As the Trump administration doubles down on fossil fuels, the rest of the world is investing more and more in clean energy.

This year, $2.2 trillion will be invested in clean energy, efficiency, and electrification globally, according to the International Energy Agency — double the $1.1 trillion that will flow toward fossil fuels.

It’s a remarkable change from a decade ago. Back in 2015, fossil fuels still attracted more money than clean energy. In 2016, perhaps galvanized by the Paris Agreement signed the very same year, investors channeled more funding toward clean energy than toward fossil fuels.

Investors haven’t looked back since — and all forms of clean energy have taken off as a result, led by China, the world’s most prominent “electrostate.” Over the last decade, wind and solar have grown from making up just over 4% of global electricity production to accounting for 15% as of last year. Solar in particular has increased eightfold over that time; no energy category will attract more money than photovoltaics this year, per IEA.

This widening gap suggests some progress in the global effort to move away from fossil fuels. Investment is a leading indicator of actual, physical things — new solar plants, wind turbines, power lines, and more — being built. The trillions invested in this year, last year, and so on, will translate to record-breaking amounts of clean-energy installations in the years to come.

But despite the promise, IEA says current investment levels are not enough to meet global pledges made in late 2023 to boost renewables and energy efficiency. Investment in renewables needs to double. Energy efficiency, a sector experts have long viewed as underfunded, needs investment to almost triple. So does electrification.

Meanwhile, fossil fuel investment has remained stubbornly high even as it loses ground to clean energy. Only in 2020, during the COVID-19 pandemic, did the world spend less than $1 trillion on coal, gas, and oil.

That mirrors a concerning trend within the global power sector: Renewables are growing at a record-breaking pace, faster than many thought possible, and yet emissions are still rising as countries simply use more electricity, burning more fossil fuels as a result. This dynamic will not solve climate change. In order for the world to decarbonize, investment in clean energy needs to be high enough for it to displace — and drive down — fossil-fuel use.

ENFIELD, N.C. — On a sweltering Saturday last month, climate activists, local elected leaders, and their families and friends gathered around a boarded-up home on the main strip of Enfield, North Carolina, donning sun hats and wielding garden tools.

To a hip-hop soundtrack blasting loud enough that the entire town of 2,000 could probably hear, the crew labored in the 90-degree heat to plant perennials, lay patio stones, and generally pretty-up the small yard in front of the nearly 1,800-square-foot bungalow.

“We are in beautification mode outside,” said Enfield Mayor Mondale Robinson, “because inside we’re at a standstill for the lack of funds right now.”

The century-old home will ultimately serve as a “weatherization hub” for Enfield, where many households hover near the poverty line but electricity bills regularly top $400. Powered by solar panels and a backup battery, the hub will host do-it-yourself energy-efficiency workshops and provide a stable internet connection for remote workers, Robinson said.

The hub is just one piece of a multifaceted clean energy vision charted by Robinson, together with other town leaders and climate nonprofits. Still recovering from a debilitating car accident from May, the wheelchair-bound mayor served as DJ, grounds supervisor, and occasional worker — to the certain chagrin of his doctor.

The scene was a fitting metaphor for where Robinson and his colleagues find themselves at the moment: hobbled by the ferocity with which the federal government has targeted clean energy and equity initiatives, but determined to press on no matter what.

“So, we stand in this heat,” Robinson said, “the same heat my grandfather and his grandfather labored in for free for somebody else. We do it for free right now, but not for somebody else — for what’s to come. It’s folk out there that don’t know that this building is for them. In spite of our federal government, in spite of, sometimes, our state government, we still stand up. We still try.”

The event last month was also about community. Climate leaders who’d worked together for years and others who’d just met took breaks in the shade to connect and reconnect.

“It’s all about people,” said Helen Whiteley, an adjunct professor at Duke University’s Design Climate program who is supporting the town in its clean energy ambitions. “When you find people who believe things that are similar, you hold onto them and try to collaborate with them.”

One of the poorest and Blackest towns in America, Enfield could have a bright future, leaders here believe: The Halifax County community could supply its own solar power, upgrade its housing stock to be more energy efficient, and create gathering places powered by clean energy.

But when Robinson and his allies were first laying their plans, the prospects for assistance from the federal government were far rosier than they are today.

The bipartisan infrastructure law and the Inflation Reduction Act — both signed into law by former President Joe Biden — promised aid for clean energy and for historically disadvantaged communities.

Federal programs spurred by these laws could have potentially funded a replacement of the town’s dilapidated and outdated grid. Tax credits might have offset at least 40% of the cost of a new solar farm and battery that would supply electricity to businesses and residences, stabilizing household electric bills. A planned resilience center on the town’s fairground, intended as a gathering place during weather disasters and as an incubator for sustainable businesses, could have also benefited.

But in six short months, President Donald Trump and the Republican-controlled Congress have shut down or imperiled many of these initiatives. The Office of Clean Energy Demonstrations, an initiative established by the 2021 infrastructure law that Enfield hoped to tap for funding, is kaput for the time being.

“That was the best one,” Nick Jimenez, senior attorney with the Southern Environmental Law Center, said with a sigh. “That could have done the grid plus solar.”

After Trump signed the budget bill into law July 4 and issued a subsequent executive order July 7, tax incentives are now sharply curtailed. Credits for home rooftop solar and energy-efficiency upgrades will dry up at year’s end.

“A fair number of our colleagues in Washington see just ink on paper,” said Rep. Rodney Pierce, a Democrat who represents Halifax County in the North Carolina House. “It’s not just letters and numbers. These are people. These are families, communities. It’s disappointing,” he said at the gathering last month.

At the same time, Pierce acknowledged, skepticism about clean energy has grown among state politicians. A bill to ratchet down local tax incentives for solar farms has cleared two committees in the state House. Another measure would eliminate an interim target for utility Duke Energy to curb its carbon emissions, removing a key driver for clean energy. The GOP-run General Assembly could yet enact the legislation, Senate Bill 266, by overriding the veto of Gov. Josh Stein, a Democrat.

Both Black men in their mid-40s, Pierce and Robinson attended rival public high schools in the county, the state legislator said. Both are quick to link the quest for clean energy to the ongoing struggle for civil rights and economic justice.

“Those of us who grew up in persistently impoverished counties like Halifax — we can ill afford to be reticent to encouraging and exploring other sources of energy,” said Pierce, who voted against SB 266. “That’s why I’m out here. I count Mayor Robinson as a friend.”

To be sure, some remnants of Biden-era climate funding have slipped through the grasp of Trump and his allies in the GOP.

A multimillion-dollar grant for grid improvements deployed to the state thanks to the infrastructure law could yet help Enfield upgrade its aging substation and low-capacity power lines. “That hasn’t been targeted yet,” Jimenez said of the program.

Funding for EnergizeNC, meant to help develop rooftop and community solar in low-income areas like Enfield, is also intact. So are rebates designed to help households buy more efficient appliances and perform other upgrades to save energy. Indeed, because of its atrocious energy burden, Halifax County was among the first two counties to access the Energy Saver North Carolina program when it launched early this year.

That’s why Enfield leaders and their allies are focused on affordable, energy-efficient housing and the weatherization hub, for now.

“This was always going to be about what we could get from philanthropy and what the mayor could marshal up from his resources,” said William Munn, regional director of the Carolinas for advocacy group Vote Solar. “We think now, given the federal situation, this is probably the most likely thing we can get done as quickly as possible.”

Robinson bought the home on South McDaniel Street earlier this year for $32,500. For another $100,000 or so, Munn believes it can be upfitted and ready to serve.

“The sooner the money comes in, the faster it gets done,” he said. “We believe this is a small enough project that, once this is done, we can market it and keep pitching it. We want to send the message that this is just the beginning.”

Robinson has high hopes for the hub’s completion. “We’re at a point now where we need people to start seeing that this thing is not 12 years away, two years away, or even a year away,” he said. “With a little investment, this thing could be done by the end of the summer.”

It’s been a bad week for the U.S. energy transition.

President Donald Trump and congressional Republicans effectively repealed large swaths of the landmark Inflation Reduction Act last Friday, a move that will set back the nation’s efforts to decarbonize just as they were gaining steam.

But the United States is not the only country in the world. It’s one of the biggest emitters, true, but it’s responsible for only about 13% of global carbon dioxide emissions.

And luckily, even as Trump hitches the U.S. to fossil fuels, the world is continuing to move quickly toward cleaner sources. Let’s take a tour of some global energy-transition bright spots.

In China, the world’s biggest carbon emitter, wind and solar capacity overtook coal and gas in the first quarter of 2025 — a first, according to a Global Energy Monitor report released this week. The country is still building and using immense amounts of fossil fuels, but reports suggest its emissions may finally be in reverse.

In the European Union, solar was the largest source of electricity across all of June. It’s the first time solar has led the pack for an entire month in the EU, according to a new Ember report, producing 22% of the region’s electricity. Meanwhile, coal fell to its lowest-ever level, a reflection of the region’s push to eliminate the dirty fuel: Ireland shuttered its last coal plant in late June, becoming Europe’s 15th coal-free country. Italy and Spain are slated to close their last major coal plants this summer, too.

Across the entire world, $2 is now invested in clean energy, efficiency, and the grid for every $1 invested in fossil fuels. That’s serious progress, and a big reason why clean energy is growing so rapidly worldwide. Last year, more than 90% of the new electricity built globally was clean energy. Meanwhile, EV adoption is set to leap 25% this year, compared with 2024, setting yet another record even amid headwinds in the U.S., according to BloombergNEF. More than one-quarter of new passenger vehicles sold worldwide will be battery-powered.

To be clear, the trajectory the world is on right now is not fast enough to meet global climate commitments. All of the progress mentioned above needs to accelerate further — and the U.S. resisting the energy transition is a big deal. But with or without the U.S., the global energy transition is happening, and a future that’s powered by solar, wind, batteries, nuclear, and other forms of carbon-free power is on the way.

Megabill fallout

One week ago today, Trump signed the GOP megabill into law and changed the trajectory of the U.S. energy transition with the stroke of a pen.

The law made deep cuts to the Inflation Reduction Act, the national climate law passed by the Biden administration in 2022. As a result, the U.S. is now expected to install clean energy at a slower pace, sell fewer EVs, and emit a lot more carbon dioxide in the coming years. Oh, and energy prices are going to rise, too. If you’re looking for a piece to share widely that covers the basics, try this one I published on Monday.

Every sector faces slightly different challenges from the law. Even geothermal energy, a favored clean energy source among Republicans, faces a rocky road, Canary’s Maria Gallucci reported this week. The law could have been worse for solar and wind — but it will still pose big challenges, Jeff St. John reports. It could even prevent some fully permitted offshore wind projects from moving forward, Clare Fieseler writes.

Trump’s pro-coal push faces challenges

A month and a half ago, the Department of Energy ordered two fossil-fueled plants that were on the brink of shutting down to stay open. It might have been an opening salvo in a major effort from the Trump administration to keep aging, dirty coal plants open past their planned close dates, Jeff St. John reported this week.

The move comes as the Trump administration, and in particular DOE Secretary Chris Wright, frequently refers to renewable energy as unreliable and calls for more fossil-fuel use instead. A new DOE report furthers that line of argument, though it has been criticized as relying on flawed assumptions. Meanwhile, examples pop up near-weekly of how clean energy actually helps the grid. During a heat wave in late June, for instance, solar and batteries helped save New England from potential blackouts, Sarah Shemkus reports for Canary Media.

Now, state regulators and environmental and consumer groups are challenging the legality of Trump’s pro-coal intervention, arguing that the grid can be safely run without it.

More reliable in Texas: Texas has dramatically increased its grid reliability and maintained affordable electricity prices as it’s integrated more solar, batteries, and wind, undermining Trump’s repeated claims that renewables make the grid unstable. (Reuters)

Rooftop regression: Rooftop solar installations are set to plummet following the GOP megabill’s repeal of a longstanding federal incentive, with analysts estimating between 40% and 85% less demand over the next decade. (Washington Post)

Ford-ging ahead: Ford says last-minute changes to Republicans’ big budget bill saved tax credits that it’s counting on as it builds a $3 billion Michigan battery factory. (New York Times)

Salt in the wound: President Trump directs the Treasury Department to strictly curtail which projects can access wind and solar tax credits before they are phased out in 2028 under the new Republican budget bill. (The Hill)

Permission denied: About one in five counties across the U.S. have passed laws to restrict or outright ban construction of new solar and wind farms, and are curtailing battery storage facilities too. (Heatmap)

A tough turn for tribes: Tribal leaders say the new federal tax and spending law will cause widespread clean-energy job losses in their communities and jeopardize climate projects. (Grist)

Drilling declines: A Federal Reserve Bank of Dallas survey shows regional oil and gas production declined in the second quarter of 2025 amid global unrest and Trump administration trade policies, and many operators say they now plan to drill fewer wells than they predicted this year. (Axios)

Heat pumps are cool: If you’re thinking about getting central air conditioning at your house — or replacing your existing system — have you considered a heat pump instead? (Canary Media)

Time to go car shopping: And if you’re contemplating getting an electric vehicle anytime soon, here’s some advice: Do it before the end of September, when the federal tax credit now sunsets under the GOP law. (Canary Media)

Have you been thinking about getting an electric vehicle? It may be time to put your foot on the accelerator.

On July 4, President Donald Trump signed the “Big, Beautiful Bill” — and thus hastened the expiration date for tax credits that knock thousands of dollars off the price of an EV.

Under former President Joe Biden’s landmark Inflation Reduction Act, these incentives would have lasted another seven years. They’ll now sunset in just a few months, on Sept. 30.

That leaves a small window of opportunity for shoppers willing to move fast.

“There are just so many benefits to driving an EV, and we encourage people to take advantage of the tax credits while they’re here,” said Ingrid Malmgren, senior policy director at the nonprofit EV advocacy organization Plug In America.

Getting an EV is one of the best ways to reduce your planet-warming pollution — on par with or better than replacing your fossil-fueled heating with a heat pump. And though they tend to cost more up front than cars that guzzle gasoline, EVs have many advantages. For starters, they provide a smoother, quieter driving experience. They also eliminate trips to the gas station and cost less to operate and maintain, pointed out Sara Baldwin, senior director of the electrification policy team at think tank Energy Innovation. A 2023 analysis by the nonpartisan group found that in every state, it’s cheaper to charge all EV models than to fill up their gas-powered counterparts.

Here’s a rundown of the incentives that are available until the end of September:

The New Clean Vehicle Credit (30D) can get you $7,500 off your federal tax bill for a brand-new, qualifying EV model that meets strict requirements around where it’s assembled and where the battery bits come from, for example. Fueleconomy.gov has a list, and dealers should be able to flag eligible vehicles. In addition, your household must earn less than $300,000 for married couples filing jointly, or $150,000 for single filers. You can get the discount right when you make your purchase.

The Used Clean Vehicle Credit (25E) can lop up to $4,000 off your federal tax bill for qualifying pre-owned EVs. The income thresholds are half of those for 30D: $150,000 for married couples filing jointly and $75,000 for single filers. You can get the discount at the point of sale.

The Commercial Clean Vehicle Credit (45W) of up to $7,500 can’t be claimed by consumers, but it benefits them anyway. Auto dealers can take the federal tax credit themselves, passing on the savings to leasing customers. Also affectionately dubbed the EV “leasing loophole,” the credit can be used for vehicles that don’t meet the stringent requirements to claim 30D.

Plus, there’s one more relevant credit that has a slightly longer lead time:

The Alternative Fuel Vehicle Refueling Property Credit (30C) provides up to $1,000 off your federal tax bill to install qualified EV charging equipment if you live in an eligible area. This credit doesn’t expire until June 30, 2026.

“The tax credits have been really powerful at helping to drive EV adoption and to make EVs more accessible to lower- and moderate-income families,” Malmgren said.

Once they’re gone, experts are expecting the growth of the EV market to slow — but not stop — under the Trump administration.

The loss of the tax credits is compounded by other headwinds from the federal government, which has imposed ever-shifting tariffs, frozen funding to build out a network of EV chargers, and revoked California’s authority to set its own vehicle emissions standards. Before Congress stripped California of that autonomy, BloombergNEF had forecast that EVs would make up just 27% of car sales in the U.S. in 2030, down from last year’s prediction of 48%. Now, the research firm expects EV sales to fall even lower.

For the next two-and-a-half months that the federal incentives are intact, automakers and dealers could drop prices to try to move their inventory more aggressively, said Loren McDonald, chief analyst at EV and charging data firm Paren.

Fueled by the tax credits, the EV market has already had a steady drumbeat of some “amazingly low lease prices,” Malmgren noted. For example, in July, the 2024 Fiat 500e and the 2025 Toyota bZ4X, an all-electric SUV, are both on offer for $179 per month, InsideEVs reports.

Customers could see more deals like these if sellers anticipate a slump in consumer interest once the tax credits expire. However, discount offers are likely to be patchy, with the most popular models maintaining higher price points if demand for them outstrips supply, McDonald said.

In the used-EV sector, the $4,000 credit can make an especially big difference; some used EVs are priced as low as $15,000 or $20,000 to begin with.

“The used EV market is quietly on fire,” said Liz Najman, director of market insights at Recurrent, a company that aggregates data on battery health from tens of thousands of EVs across the United States. Used EVs are selling faster than at any point since COVID, she added.

Check out Recurrent’s guide to shopping for used EVs and Plug In America’s PlugStar.com, a brand-neutral resource to help people find the vehicle that’s right for them. Type in your ZIP code, and the site shows you local EV incentives.

Have specific features you want in your vehicle? Find a match for your needs — including range, seating, four-wheel-drive, and more — with Plug In America’s virtual shopping assistant. The tool can connect you to dealers registered with the IRS to provide federal EV tax credits.

“Given all the changes going on, try to find a dealer that offers the point-of-sale rebate,” Najman said, so you don’t have to worry about claiming it yourself next tax season. “Work with a dealer who has IRS credentials, who can show you on the spot that they’re logging in and the car is qualified.”

If you run into trouble in your EV search, you can reach out to Plug In America; the nonprofit offers free one-on-one support for prospective and current EV drivers.

And don’t forget to land on your charging strategy — at home, work, or a public station. If you decide to get a charger, install it before you bring your EV home for ultimate convenience.

“The clock is now ticking on the federal tax incentives for new, used, and leased EVs,” Najman said. “The sooner you start looking, the better.”

In late spring, the Department of Energy ordered two aging and costly fossil-fueled power plants that were on the verge of shutting down to stay open. The agency claimed that the moves were necessary to prevent the power grid from collapsing — and that it has the power to force the plants to stay open even if the utilities, state regulators, and grid operators managing them say that no such emergency exists.

More of these orders could be on the way. The DOE published a report this week, in response to one of the “Beautiful Clean Coal” executive orders issued by President Donald Trump in April, that lays out the case for Energy Secretary Chris Wright, a former gas industry executive who has denied there is a climate change crisis, to demand that more fossil-fueled plants remain open past their scheduled closures.

But state regulators, regional grid operators, environmental groups, and consumer groups are pushing back on the notion that the grids in question even need these interventions — and are challenging the legality of the DOE’s stay-open orders.

Last month, state utility regulators and environmental groups filed rehearing requests with the DOE, demanding that it reconsider emergency orders to force the J.H. Campbell coal plant in Michigan and the Eddystone oil and gas-burning plant in Pennsylvania to stay open through the summer.

The DOE claimed that the threat of large-scale grid blackouts forced its hand. But state utility regulators, environmental groups, consumer advocates, and energy experts say that careful analysis from the plant’s owners, state regulators, regional grid operators, and grid reliability experts had determined both plants could be safely closed.

These groups argue that clean energy, not fossil fuels, are the true solution to the country’s grid challenges — even if the “big, beautiful” bill signed by Trump last week will make those resources more expensive to build. Some of the environmental organizations challenging DOE’s orders have pledged to take their case to federal court if necessary.

“We need to get more electrons on the grid. We need those to be clean, reliable, and affordable,” said Robert Routh, Pennsylvania climate and energy policy director for the Natural Resources Defense Council, one of the groups demanding that DOE reconsider its orders. Keeping J.H. Campbell and Eddystone open “results in the exact opposite. It’s costly, harmful, unnecessary, and unlawful.”

The groups challenging the DOE’s J.H. Campbell and Eddystone stay-open orders point out that the agency is using a power originally designed to protect the grid against unanticipated emergencies, including during wartime, but without proving that such an emergency is underway.

“This authority that the Department of Energy is acting under — Section 202(c) of the Federal Power Act — is a very tailored emergency authority,” said Caroline Reiser, NRDC senior attorney for climate and energy. “Congress intentionally wrote it only to be usable in specific, narrow, short-term emergencies. This is not that.”

For decades, the DOE has used its Section 202(c) power sparingly, and only in response to requests from utilities or grid operators to waive federal air pollution regulations or other requirements in moments when the grid faces imminent threats like widespread power outages, Reiser said.

But the DOE’s orders for Eddystone and J.H. Campbell were not spurred by requests from state regulators or regional grid operators. In fact, the orders caught those parties by surprise.

They also came mere days before the plants were set to close down and after years of effort to ensure their closure wouldn’t threaten grid reliability. J.H. Campbell was scheduled to close in May under a plan that has been in the works since 2021 as part of a broader agreement between utility Consumers Energy and state regulators, and which was approved by the Midcontinent Independent System Operator (MISO), the entity that manages grid reliability across Michigan and 14 other states.

“The plant is really old, unreliable, extremely polluting, and extremely expensive,” Reiser said. “Nobody is saying that this plant is needed or is going to be beneficial for any reliability purposes.”

To justify its stay-open order, the DOE cited reports from the North American Electric Reliability Corp. (NERC), a nonprofit regulatory authority that includes utilities and grid operators in the U.S. and Canada. NERC found MISO is at higher risk of summertime reliability problems than other U.S. grid regions, but environmental groups argue in their rehearing request that the DOE has “misrepresented the reports on which it relies,” and that Consumers Energy, Michigan regulators, and MISO have collectively shown closing the plant won’t endanger grid reliability.

Eddystone, which had operated only infrequently over the past few years, also went through a rigorous process with mid-Atlantic grid operator PJM Interconnection to ensure its closure wouldn’t harm grid reliability. The DOE’s reason for keeping that plant open is based on a report from PJM that states the grid operator might need to ask utility customers to use less power if it faces extreme conditions this summer — an even scantier justification than what the agency cited in its J.H. Campbell order, Reiser said.

As long as the DOE continues to take the position that it can issue emergency stay-open orders to any power plant it decides to, these established methods for managing plant closures and fairly allocating costs will be thrown into disarray, she said.

“We have a system of competitive energy markets in the United States that is successful in keeping the lights on and maintaining reliability the vast, vast majority of the time,” Reiser said. “The Department of Energy stepping in and using a command-and-control system interferes with those markets.”

Utility regulators from MISO states including Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota, and Wisconsin made a similar argument in their rehearing request to the DOE. “This expansive use of emergency powers sets a troubling precedent, enabling intervention in routine, state-approved planning decisions without an actual crisis,” they wrote. “Such preemptive action risks undermining the credibility of future emergency orders, distorting market signals, and eroding the statutory balance between federal and state authority.”

Dan Scripps, chair of the Michigan Public Service Commission, highlighted the years of work that went into enabling the J.H. Campbell plant to safely close, and the hundreds of millions of dollars that replacing it with fossil gas, solar, and battery resources would save.

“For DOE to substitute its judgment of what’s necessary for the work that’s done by the states and the regional grid operators is something that a large number of states of different political makeups find most troubling,” he said.

Forcing aging and expensive power plants to stay open past their long-planned retirement dates also threatens to drive up costs for utility customers at a time when energy prices are already set to rise due to GOP policies. Think tank Energy Innovation forecasts the megabill passed by congressional Republicans last week will lead to a 25% increase in wholesale electricity prices by 2030, as cuts to tax credits stifle investment in solar, wind, and battery projects and force power grids to rely on older, costlier resources.

This week’s DOE report “is another attempt to push the false narrative that our country’s energy future depends upon decades-old coal- and gas-plants, rather than clean renewables,” Greg Wannier, senior attorney at the Sierra Club, said in a statement. “The only energy crisis faced by the American public is the catastrophic increase in costs that the Trump Administration is forcing on the country’s ratepayers.”

Coal has fallen from nearly half U.S. generation capacity in 2011 to just 15% last year, and more than 120 U.S. coal plants are expected to close over the next five years. Coal industry groups and many Republicans blame state climate regulations for that trend. But energy experts agree that the primary driver is that coal plants are unable to provide power at prices that can compete with fossil gas or renewables.

Aging power plants like J.H. Campbell and Eddystone, which were built roughly 60 years ago, are among the most expensive to run — one of the main reasons why those two were both slated for retirement. Forcing them to restart and stay open for three months on the eve of their planned closures involves additional costs to secure new fuel contracts, undertake deferred maintenance, and rehire workers.

Utility customers in the Midwest and mid-Atlantic grid regions those plants are connected to will now bear all of those costs. While the total dollar amount has yet to be calculated, it could run into the tens of millions for each plant, or as much as $100 million for J.H. Campbell, Scripps told reporters in June.

Under its Section 202(c) authority, the DOE doesn’t have to deal with the costs its emergency orders incur, said Clara Summers, campaign manager for the Citizens Utility Board, an Illinois-based utility customer watchdog group. Instead, it gets to delegate the method of recovering those expenses to grid operators and regulators.

But the DOE has failed to show that keeping those plants open will benefit customers, which puts those entities in a bind.

“There is a standard in ratemaking that costs should be prudently incurred,” Summers said. “Since these costs are manufactured emergencies and are not prudently incurred, they are not just and reasonable.”

That’s the argument that environmental and consumer watchdog groups have made in filings with the Federal Energy Regulatory Commission, the agency tasked with overseeing the U.S. power grid. The groups have asked FERC to reject plans to recover costs from DOE’s J.H. Campbell and Eddystone orders on the grounds that the DOE has failed to show how keeping the plants open will benefit consumers.

“What’s especially frustrating about that is that we already have capacity markets that are there to make sure that we have enough electricity, and consumers already pay for that,” Summers said. Those costs to utility customers are rising dramatically in PJM, where years of backlogged interconnection processes have prevented new solar, wind, and battery projects from coming online to help replace power plants being closed. MISO also saw prices spike in its most recent capacity auction.

“The whole function of those markets is to ensure we have enough electricity — and those markets procure enough electricity,” Summers said. “This is something PJM agrees with, that MISO agrees with, that NERC agrees with.”

The DOE has 30 days from when the rehearing requests were filed to open a review of its stay-open orders, Reiser said. If the DOE doesn’t issue an order within that time, “it basically opens up the option for us to go to court.”

The DOE has never used its Section 202(c) authority in this way before, which means it has never been challenged in court on the issues at hand, Reiser said.

But “the fact that there are related executive orders kind of directing the Department of Energy to do these things doesn’t change the basic standards of how our legal system works and how courts interpret statutes,” she added. “No matter the reasoning, they still have to comply with the law.”

Geothermal energy was spared in President Donald Trump’s sweeping tax and spending law, which made deep cuts to incentives for other forms of clean energy. But developers of the resurgent energy source may still face difficulties ahead due to complex stipulations folded into the new law, among other Trump administration policies.

The “big, beautiful” Republican legislation largely preserves investment and production tax credits for geothermal power plants — as well as battery storage, nuclear, and hydropower projects — established by the Inflation Reduction Act. Incentives for wind and solar, however, are sharply curtailed, and subsidies for residential clean energy projects will abruptly end after this year.

Geothermal advocates celebrated the outcome for their industry, which they say will be vital to scaling the resource in the United States to meet the nation’s soaring power demand. The sector has attracted a lot of attention in recent years because it can provide carbon-free power around the clock — something solar and wind can’t do — and technological advances are making it possible to deploy geothermal in places that conventional plants can’t go.

This “policy milestone highlights the geothermal industry’s role in fortifying grid resilience and national security,” Vanessa Robertson, director of policy and education for Geothermal Rising, an industry association, said in a statement. “With certainty in place, we look forward to seeing projects advance and innovative partnerships flourish.”

Still, the industry isn’t immune to the broader market challenges created by Trump’s policies, despite its more favorable treatment from Congress.

New tariffs on things like steel and aluminum have increased the cost of drilling equipment, heat exchangers, and other key components. A provision in the budget bill aimed at restricting Chinese companies and individuals from accessing tax credits will make it harder for developers to prove compliance, increasing the risk for investors who finance clean energy projects.

“We’re making an ugly layered cake of barriers to quick and clean project development,” said Advait Arun, a senior associate for energy finance at the Center for Public Enterprise, a nonprofit think tank.

Geothermal plants, which harness Earth’s heat to generate power, have for decades represented less than 1% of the U.S. electricity mix. That’s because conventional plants tend to be viable only when located near natural formations like hot springs, where the heat is easier to reach, but which only occur in a handful of places in the United States.

New tools and techniques are emerging that make it possible to put geothermal plants in more parts of the country.

The startup Fervo Energy completed America’s first “enhanced geothermal system” in late 2023 — a 3.5-megawatt pilot plant in Nevada backed by Google. Now, the Houston-based company is building the world’s first large-scale enhanced geothermal plant in Utah’s high desert. Fervo has raised hundreds of millions of dollars in capital to drill dozens of wells for the 500-megawatt Cape Station, with the first 100 MW slated to start delivering power to the grid in 2026.

In June, the startup XGS Energy announced plans to build a 150-MW next-generation geothermal project in New Mexico by 2030 to support Meta’s data center operations. Meta, which owns Facebook and WhatsApp, signed a similar agreement last year with Sage Geosystems to build 150 MW of geothermal power at an unspecified site east of the Rocky Mountains. The first phase of that project is set to come online in 2027.

Geothermal has long drawn bipartisan support and has so far dodged Trump’s broader attacks on renewable energy. It helps that the new geothermal wave has considerable overlap with the oil and gas industry, sharing the same drilling equipment, workforce, and investors. U.S. Energy Secretary Chris Wright, previously the CEO of a fracking company that invested in Fervo, played an active role during budget negotiations to shield geothermal from sweeping cuts to Inflation Reduction Act incentives.

Under the new law, geothermal and other baseload clean power sources can qualify for the full 48E investment tax credit or the 45Y production tax credit if they begin construction by 2033, after which point the credits will gradually decrease to zero in 2036. The concrete phase-out schedule differs from the IRA, which allowed more flexibility and could’ve kept the incentives in place for several more years, according to Geothermal Rising.

Wind and solar facilities, meanwhile, must either start operating before the end of 2027 or begin construction by next summer to obtain credits. Geothermal heat pumps, which heat and cool buildings, will lose access to residential tax credits after 2025.

For next-generation geothermal firms, the tax incentives are crucial to getting the first slate of projects up and running. Developers use the promise of future tax credits as collateral to raise the many millions in financing they need to explore suitable project sites and deploy novel drilling technologies. The credits also help to attract major customers, including tech giants that are looking for a variety of baseload power sources to run their sprawling data centers.

“They help the market to develop,” said Mehdi Yusifov, the director of data centers and AI at Project InnerSpace, a geothermal advocacy group. “Tax credits of this kind can … help get infrastructure built on a mega scale.”

Yusifov and Nico Enriquez, a principal at Future Ventures, studied the potential cost of serving a “hyperscale” data center with power from a 1-gigawatt enhanced geothermal project in a place like the Western U.S. In a new analysis, they found this novel project could achieve a levelized cost of energy of $119 per megawatt-hour without the investment tax credit — significantly better than estimated costs for nuclear power. With the tax credit, the hypothetical geothermal system could achieve $88 per megawatt-hour, which is competitive with the upper range for a fossil-gas power plant.

“It seems like there’s a dam that would break if it could be proven that [geothermal] can produce power anywhere in the range below Three Mile Island,” said Enriquez, referring to the shuttered nuclear plant in Pennsylvania that is expected to restart to serve Microsoft’s growing energy appetite.

“That’s another reason why this investment tax credit is so important, because it makes it possible to have the dam break,” he added. “And suddenly you can flood the market with these projects that are giving us critical infrastructure.”

It’s unclear whether the budget bill will undermine some next-generation projects due to the anti-China provisions attached to these key incentives. The rules, known as “foreign entity of concern” restrictions, will require companies to scrutinize their supply chains to an unprecedented degree, with potentially onerous and costly legal implications that make it harder for projects to claim incentives.

“It remains to be seen how developers of these really innovative technologies can navigate this, because it’s not going to be the easiest process from here on out,” said Arun of the Center for Public Enterprise.

Even as the headwinds swirl, geothermal developers continue to make significant strides to improve their technologies. Both Fervo and the federal Utah Forge initiative have said they’ve dramatically increased drilling speeds and efficiencies in just a handful of years, with Fervo reducing its per-well costs by millions of dollars. For startups, access to tax incentives allows them to get to work to make such advances in the field, Enriquez said.

“There’s an amount we save long-term if we invest upfront in these tax credits, because of the learning curve,” he said. “If we can maintain [the momentum] for the next five years, I think this industry will be one of the key power sources for the U.S.”

The megabill passed by Republicans in Congress and signed into law by President Donald Trump last week creates many challenges for clean energy — enough to choke off lots of new solar and wind power projects, and cast uncertainty over everything from battery storage deployments to EV factories.

The only saving grace is that it could have been much worse.

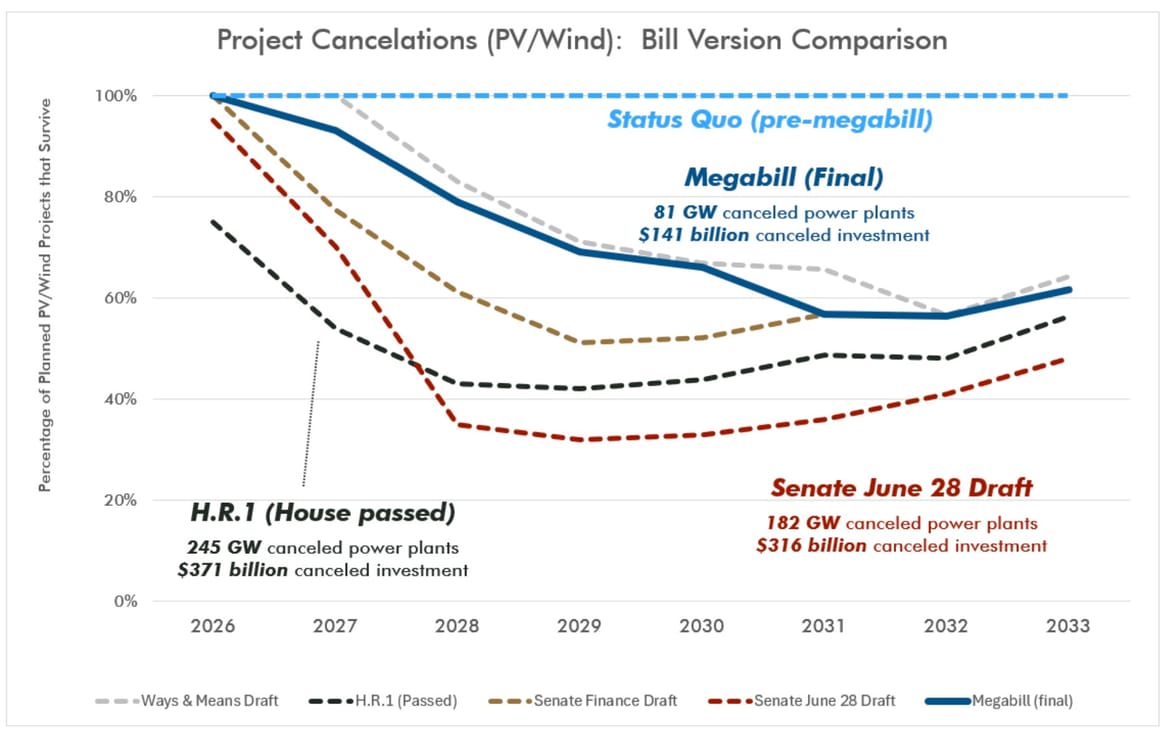

The new law could reduce investment in solar and wind projects by about $141 billion and kill 81 gigawatts of potential new generation capacity through 2033 compared to what would have happened if it didn’t pass, according to estimates from solar and battery project investor Segue Sustainable Infrastructure.

But previous versions of the bill from House Republicans, and a draft unveiled by Senate Republicans on June 28, would have spelled the demise of more than twice as much clean power and domestic investment, according to Segue’s previous analyses.

What changed? A handful of Senate Republicans, pressed by clean energy advocates, amended the bill in the industry’s favor, averting “a complete catastrophe,” according to David Riester, founder and managing partner of Segue, which is involved in about 120 solar and battery projects across the country.

Nevertheless, the law still rapidly phases out tax credits for solar and wind.

Under the Inflation Reduction Act, projects that started construction before 2033 were assured tax credits that they could use or sell to reduce the cost of building, and thus, the price of the power they offer to long-term offtakers, like utilities or corporations. Although the new law largely preserves that timeline for geothermal, nuclear, hydropower, and battery storage development, it dramatically tightens the deadlines for wind and solar projects, requiring them to either be operating by the end of 2027 or start construction by next summer to access incentives.

Developers and financiers like Segue now have 12 months to decide whether they believe a given wind or solar installation can hit the milestones required to access crucial tax credits.

If they don’t think it can, they’ll pull out of the project. That could mean a lot of abandoned plans for Segue, whose portfolio is mostly made up of earlier-stage developments.

“We often pose the question to each other: ‘If we lean into this, are we investing, or are we gambling?’’’ Riester said. “There are some project profiles for which the answer will almost certainly be ‘gambling’ a year from now, and we will kill those.”

Segue isn’t alone. Financiers and developers across the country are grappling with this as they consider whether to move forward with much of the hundreds of gigawatts of solar, battery, and wind projects being planned around the country.

“When you rip the rug out suddenly, it creates a moment where the owners of all these projects, in their various stages of development, have to face the fact that they don’t know exactly what their revenue line is going to look like,” Riester said.

Developers ultimately have little control over when a project can connect to the grid and start delivering power. That’s why the most vital change in the final version of the bill is one pushed by Sens. Joni Ernst (R-Iowa), Lisa Murkowski (R-Alaska), and Chuck Grassley (R-Iowa), which gives wind and solar projects until July 4, 2026, to start construction to secure tax credit eligibility.

Projects that meet this deadline will be eligible as long as they’re completed and placed in service within four years of start of construction. Previous versions of the bill would have given those projects only 60 days to commence construction, and then required them to be placed into service by 2028 to win credits.

But project developers called the “placed in service” deadline tantamount to an immediate tax-credit cutoff, given the impossibility of being able to assure investors that they’d be able to get online in time. Already, grid bottlenecks force projects to wait an average of five years to secure interconnection.

The “commence construction” status is the traditional hinge point for tax credit eligibility. It’s far more within a developer’s control than placing a project into service, and can be verified using established methods like the “5% safe-harbor test,” which involves incurring 5% or more of the total cost of the facility in the year construction begins.

With 12 months to reach this construction milestone, project developers have “a bit more time to see how projects’ existing development risks evolve before the ‘Do I safe harbor this project?’ question requires an answer and action,” Riester said.

There is a cloud hanging over relying on safe harbor provisions, however, noted Andy Moon, CEO and cofounder of Reunion Infrastructure, a company working in the multibillion-dollar market for clean-energy tax credit transfers. President Trump issued an executive order on Monday directing the Treasury Department to issue guidance restricting the use of “broad safe harbors unless a substantial portion of a subject facility has been built.”

That’s a “significant departure” from what project developers were planning for, Moon said. “Developers are scrambling to figure out how the Treasury might modify safe harbor rules.”

Not all of the wind and solar farms that could get started in the next 12 months will be able to, said Jim Spencer, president and CEO of Exus Renewables North America, a company that owns and builds clean energy.

The new mid-2026 deadline will launch a rush to secure all the equipment that projects require. Some developers will inevitably be crowded out, unable to buy what they need in time.

“We’re a well-capitalized developer with the ability to buy equipment in advance,” Spencer said, but not all firms are in the same position. “A lot of the less well-capitalized developers may have good projects. But if they can’t grandfather those projects, either by starting construction or by procuring equipment, there’s not much of a value proposition there.”

That looming deadline also presages a big drop in new solar and wind projects later this decade, once the last ones eligible for tax credits are built.

“You’ll have a rush of safe-harboring” before the 12-month period expires, Moon said. “But greenfield development is going to freeze after that until the market adjusts.”

That’s because energy buyers won’t immediately want to accept the higher prices set by developers who lack the financial boost of tax credits. “There’s going to be a price-discovery phase, when project developers all of a sudden are missing capital for 30% to 40% to 50% of their project costs,” he said. “Electricity prices are going to have to rise significantly to make up the shortfall.”

Wholesale electricity prices could increase 25% by 2030 and 74% by 2035 due to the loss of low-cost renewable energy and a rise in the cost of fossil gas to fuel the power plants that will need to make up the difference, according to modeling of the law from think tank Energy Innovation.

The process of price discovery will lead to what Riester described as a “price correction” — energy buyers coming to terms with how much more expensive electricity will become and making deals accordingly. But that will take some time.

In the meantime, there will be a gap in the deployment of clean energy — by far the biggest source of new power on the U.S. grid. That gap will have consequences as power demand is climbing nationwide.

Slower power-plant growth will significantly disrupt the electricity needs of factories, data centers, big-box stores, and “everything that we want to bring back onshore” that are “teed to these power projects,” Sen. Thom Tillis (R-N.C.), one of three Senate Republicans who voted against the bill, said in a speech on the chamber’s floor in late June. The disruptions will cause “a blip in power service, because there isn’t going to be a gas-fired generator anytime soon.”

Developers face wait times of five to seven years for new gas turbines. Nuclear and geothermal power plants take even longer to build.

Eventually, the market will find a new equilibrium. If solar, wind, and batteries are the only power sources that can be built quickly in the near term, utilities and corporate customers will figure out a price they’re willing to pay.

“But on the way to that steady state, there will be a lot of rockiness in the market,” Riester said. During that time, Segue and many other energy-market observers predict a significant shortfall in new power supply to meet demand.

“There will still be tons of projects in that 2028 to 2031 window that get killed because visibility into economic viability fails to arrive before development expenses become uncomfortably high,” Riester said. “That’s where the capacity shortage is likely to peak” — when Trump’s presidency will be over.

As temperatures across New England soared above 100 degrees Fahrenheit in recent weeks, solar panels and batteries helped keep air conditioners running while reducing fossil-fuel generation and likely saving consumers more than $20 million.

“Local solar, energy efficiency, and other clean energy resources helped make the power grid more reliable and more affordable for consumers,” said Jamie Dickerson, senior director of clean energy and climate programs at the Acadia Center, a regional nonprofit that analyzed clean energy’s financial benefits during the recent heat wave.

On June 24, as temperatures in the Northeast hit their highest levels so far this year, demand on the New England grid approached maximum capacity, climbing even higher than forecast. Then, unexpected outages at power plants reduced available generation by more than 1 gigawatt. As pressure increased, grid operator ISO New England made sure the power kept flowing by reducing exports to other regions, arranging for imports from neighboring areas, and tapping into reserve resources.

At the same time, rooftop and other “behind-the-meter” solar panels throughout the region, plus Vermont’s network of thousands of batteries, supplied several gigawatts of needed power, reducing demand on an already-strained system and saving customers millions of dollars. It was a demonstration, supporters say, of the way clean energy and battery storage can make the grid less carbon-intensive and more resilient, adaptable, and affordable as climate change drives increased extreme weather events.

“As we see more extremes, the region still will need to pursue an even more robust and diverse fleet of clean energy resources,” Dickerson said. “The power grid was not built for climate change.”

On June 24, behind-the-meter solar made up as much as 22% of the power being used in New England at any given time, according to the Acadia Center. At 3:40 p.m., total demand peaked at 28.5 GW, of which 4.4 GW was met by solar installed by homeowners, businesses, and other institutions.

As wholesale power prices surpassed $1,000 per megawatt-hour, this avoided consumption from the grid saved consumers at least $8.2 million, according to the Acadia Center.

This estimate, however, is conservative, Dickerson said. He and his colleagues also did a more rigorous analysis accounting for the fact that solar suppresses wholesale energy prices by reducing overall demand on the system. By these calculations, the true savings for consumers actually topped $19 million, and even that seems low, Dickerson said.

In Vermont, the state’s largest utility also relieved some of the pressure on the grid by deploying its widespread network of residential and EV batteries. That could save its customers some $3 million by eliminating the utility’s need to buy expensive power from the grid and reducing fees tied to peak demand.

“Green Mountain Power has proven that by making these upfront investments in batteries, you can save ratepayers money,” said Peter Sterling, executive director of trade association Renewable Energy Vermont. “It’s something I think is replicable by other utilities in the country.”

Green Mountain Power’s system of thousands of batteries is what is often called a “virtual power plant” — a collection of geographically distributed resources like residential batteries, electric vehicles, solar panels, and wind turbines that can work together to supply power to the grid and or reduce demand. In Vermont, Green Mountain Power’s virtual power plant is its largest dispatchable resource, spokesperson Kristin Carlson said. The 72-MW system includes batteries from 5,000 customers, electric school bus batteries, and a mobile, utility-scale battery on wheels.

The network began in 2015 with the construction of a 3.4-megawatt-hour storage facility at a solar field in Rutland, Vermont. Two years later, the utility launched a modest pilot program offering Tesla’s Powerwall batteries to 20 customers, followed in 2018 by a pilot that paid customers to share their battery capacity during high-demand times. In 2022, a partnership with South Burlington’s school district linked electric school buses to the system, and in 2023, state regulators lifted an annual cap on new enrollments it had imposed on a Green Mountain Power program that leases batteries to households. The number of customers with home batteries has since grown by 72%.

“We’ve had a really dramatic expansion,” Carlson said. “It is growing by leaps and bounds.”

The network saved consumers money during the heat wave by avoiding the need to buy power at the high prices the market reached that day, but also by helping to lower the “capacity fees” charged by ISO New England. These charges are determined by the one hour of highest demand on the grid all year, and then allocated to each utility based on their contributions to that peak. By pulling power from batteries rather than just the grid, Green Mountain Power lowered its part of the peak.

If the afternoon of June 24 remains the time of peak demand for 2025, Green Mountain Power’s 275,000 customers will save about $3 million in total and avoided power purchases, the utility calculated. Looking ahead, more hot weather and further expansion of the utility’s virtual power plant will likely continue to put money back in customers’ pockets, Sterling said: “When you play that out over many years, that’s real savings to ratepayers.”

President Donald Trump’s new “big, beautiful” law repeals many — but not all — of the U.S.‘s clean-energy tax credits. The incentives that remain, though, could still prove prohibitively complex, rendering them effectively useless for energy project developers and manufacturers.

That’s because of a provision in the bill aimed at restricting Chinese companies and individuals from benefiting from those tax credits. These restrictions on “foreign entities of concern” — “FEOC” for short — combine harsh penalties with very little guidance on compliance. The impact of rules meant to limit U.S. funds flowing to China could, ironically, be to undermine U.S. efforts to compete with China, which dominates many of the industries that will bear the brunt of the requirements, experts say.

The ramifications of FEOC rules will be felt most by developers of grid-scale battery, geothermal, and nuclear energy projects as well as by companies that produce batteries, solar panels, and critical minerals in the United States. The law preserved tax credits for these sectors until the 2030s, subject to FEOC provisions.

The FEOC provisions in the bill passed last week aren’t as strict as those that emerged from a House version of the bill in May, experts say. But they’re still complex enough that experts fear it will take the U.S. Treasury Department a long time to finalize its rules for compliance. The bill sets a deadline for the department to issue its FEOC rules by the end of 2026.

During the Biden administration, the department took a year and a half to craft rules for a much narrower set of FEOC restrictions for electric vehicle batteries under the Inflation Reduction Act. It’s unlikely the agency — understaffed and overworked following cuts from the Trump administration — will be able to finalize rules for these much broader restrictions in a timely fashion, said Ted Lee, a former Biden administration Treasury official who worked on those EV tax credits.

That puts the industry in a bind. Until the guidance is finished, it will be risky for companies to claim tax credits — and riskier yet for the investors who finance clean-energy projects and factories by purchasing these credits to offset their own tax bills. These entities would face the risk of eventually having their tax credits clawed back if they’re later found to be in violation of the as-yet-unwritten rules, Lee said, among other penalties.

“When I talk to developers, manufacturers, lawyers, and tax insurers and other participants in this market, they’re not sure how they’re going to deal with this,” Lee said. “There’s a risk that some projects get so burdened in compliance and red tape that projects and investments that should move forward will not be able to.”

To make matters more challenging, the IRS has a long time to challenge tax credit claims, said Andy Moon, CEO and cofounder of Reunion Infrastructure, a company that offers software and services to support the multibillion-dollar market for tax-credit transfers. The department has six years after a return is filed, and can assess a 20% penalty for incorrect claims — in addition to clawing back the value of the credit.

The confusion ultimately threatens to put hundreds of billions of dollars worth of planned investment in clean-energy projects and factories on ice while companies wait for the details to take shape. It could also sow chaos for the hundreds of billions of dollars worth of existing projects that have been built with the assumption that they could access Inflation Reduction Act tax incentives.

It’s unclear whether every company will be able to find alternative suppliers that comply with the FEOC rules. China makes most of the world’s solar and lithium-ion battery materials and components, including those used in domestic installations and factories. For some projects, that might be OK. Certain energy developments and factories will still make economic sense without tax credits. But plenty won’t.

“The industry has not yet fully absorbed the potential impact of FEOC rules, which will kick in starting in 2026,” said Moon. “And I think that some market participants are looking at it and raising the alarm bells.”

In particular, the “material assistance” rules that go into effect next year will prove a challenge for firms, Moon said. Under those rules, factories and energy projects seeking to claim tax credits must have an increasing proportion of materials coming from companies and sources that aren’t linked to FEOC.

For manufacturers seeking credits under the Inflation Reduction Act’s 45X program, those proportions will rise from 60% in 2026 to 85% in 2030 for lithium-ion batteries, while the proportions for solar manufacturers will rise from 50% to 85% over the same time period, for example. Manufacturers of other products have their own ratios, as do wind, solar, battery, geothermal, and nuclear power projects.

It won’t be easy for companies to prove they’ve met those thresholds, Lee said. “To do that, you have to go through a calculation that’s described at a high level in the text” of the bill, he said. “But the details of how you do that calculation are somewhat unclear,” with only passing reference to existing domestic-content “safe harbor” guidance for solar, wind, and battery projects.

Yogin Kothari, chief strategy officer for Solar Energy Manufacturers for America, a coalition of U.S. solar-equipment makers, said that the companies in his organization are working with the Trump administration and members of Congress to forward “a set of rules that supports domestic manufacturers and drives demand for domestic manufacturing. Anything that undermines that will have a negative impact on these manufacturing communities.”

GOP lawmakers have good reason to develop workable rules: The vast majority of manufacturing investment generated by the Inflation Reduction Act is flowing to Republican congressional districts.

Spencer Pederson, senior vice president of public affairs for the National Electrical Manufacturers Association (NEMA) trade group, highlighted the work that the organization and its member companies have taken to comply with existing “Build America, Buy America” rules set by the 2021 Infrastructure Investment and Jobs Act. Those kinds of efforts could help companies prepare to comply with the FEOC rules set to emerge from the Treasury Department, he said.

“NEMA is going to work with Treasury as best as possible to ensure that the guidance is clear and consistent and produced in a timely enough manner for companies to use the credit for those that wish to take advantage of it,” he said. Even so, “there’s going to be a decision for a number of companies and organizations as to whether or not the juice is worth the squeeze.”

But some sectors don’t have an existing framework to look to. Such guidance doesn’t exist for geothermal and nuclear power projects, or for inverters and other grid equipment, noted Advait Arun, senior associate for energy finance at the Center for Public Enterprise, a nonprofit think tank. Until the Treasury Department releases guidance on those technologies, “it’s going to be tough, if not impossible” for developers of those projects to know how to calculate their exposure to FEOC, he said.

Even if Treasury guidance does eventually offer some clarity, companies are almost certainly going to struggle to obtain the depth of information the FEOC rules in the bill appear to require. Companies tend to be secretive about their exact suppliers, Lee said, adding that this difficulty was part of what slowed down the Biden administration’s rulemaking around domestic content requirements.

“Even if you know what you’re trying to calculate, actually getting that information from your suppliers — and in many cases your suppliers’ suppliers,” as the FEOC rules require, Lee said, “is going to be extremely difficult.”

Ultimately, the extent to which this complexity slows down growth in clean energy and manufacturing construction will depend on the Treasury’s guidance, which could take years to be issued.

“I don’t know yet how hard [compliance] is going to be,” said Harry Godfrey, head of federal affairs for trade organization Advanced Energy United. “It depends on where the administration engages in additional guidance, and if it’s helpful — which we hope it would be — or if it is disruptive.”

Even before those “material assistance” restrictions begin next year, companies will need to prove they aren’t what the FEOC rules define as “specified foreign entities” or “foreign-influenced entities” to ensure they are eligible to receive tax credits.

“Those rules come into effect regardless of when you start construction,” Lee said.

These restrictions could embroil many factories and projects already built or under construction. More than 100 existing or planned U.S. solar or battery factories are owned by Chinese parent companies or backed by majority-Chinese shareholders, according to BloombergNEF analysis obtained by Heatmap.

Other companies “might not actually be owned or influenced by Chinese companies, but maybe they haven’t done all the many tests now required to prove that,” Lee said. “There’s going to be this immediate compliance hit, even for projects that have begun production or [are] about to get turned on.”

Companies under majority-Chinese ownership, such as Japan-based lithium-ion battery manufacturer AESC, have already frozen hundreds of millions of dollars’ worth of U.S. factory plans. House Republicans have previously attacked other projects that license Chinese technology, such as Ford Motor Co.’s battery plant in Michigan that uses technology from China-based battery giant Contemporary Amperex Technology Co., Limited (CATL).

“Effective control” provisions that direct the Treasury to write guidance that could bar tax credits to projects or factories that have made contract or licensing payments to specified foreign entities are particularly problematic, Lee said. “There’s an extremely broad category of things that could be caught up in that, particularly in the battery space.”

Overshadowing all these uncertainties is the fear that the Trump administration will not engage in the same good-faith approach that the Biden administration took to work with U.S. companies in their efforts to comply with FEOC rules.

Already, reports have surfaced of a deal struck between members of the ultraconservative House Freedom Caucus and Trump, who reportedly has agreed to impose administrative burdens and aggressive interpretations of agency rules to prevent solar and wind projects from being able to use the tax credits that remain available to them over the next two years.

On Monday evening, Trump issued an executive order calling on the Treasury to “take prompt action” within 45 days of the One Big, Beautiful Bill’s enactment to implement the law’s FEOC restrictions. “Reliance on so-called ‘green’ subsidies threatens national security by making the United States dependent on supply chains controlled by foreign adversaries,” the order says.

Under the new law, Republicans in Congress could choose to launch investigations into companies and refer their claims to the IRS.

“Historically IRS enforcement has been independent from the political appointees in the executive branch,” Lee said. “The norms and laws that provide that protection are being eroded by this administration. As a result, it’s quite concerning to think about what actions the Trump administration might put pressure on the IRS to take, and what enforcement priorities this administration would have.”

Lee noted that tax-credit financing structures have always had to deal with the risks that credits might be challenged by the IRS, with insurance products and careful lawyering by counterparties in tax-equity and tax-credit transfer deals. But the One Big, Beautiful Bill Act introduces a deeper level of risk than ever before.

“There will be some kind of framework for risk-mitigation strategies that will arise to handle these issues,” Lee said. “The question is, how quickly will that happen — and how much risk will the market be willing to take on?”

An update was made on July 8, 2025: This story has been updated to include details on Trump’s July 7 executive order regarding the implementation of FEOC rules.

On June 30, after an exhausting round of late-night negotiations, Delaware state legislators passed a bill to effectively green-light the Southeast’s second offshore wind farm. Within days, lawmakers in Washington passed legislation that may doom its future.

MarWin, the first phase of a 114-turbine project off the Delmarva Peninsula, is slated for installation in 2028 with onshore construction possibly starting next year, but that timeline is perhaps unrealistic, said Harrison Sholler, an offshore wind analyst with BloombergNEF. MarWin doesn’t have its financing in place yet to underwrite construction and, to make matters worse, Congress just unleashed a crushing new deadline.

When President Donald Trump signed the “Big, Beautiful Bill” on Friday, he dramatically shortened the window in which offshore wind projects can qualify for tax credits that offset up to 30% of their costs. The law now requires new wind farms be “placed in service” by the end of 2027 or begin construction by July 4, 2026, to qualify.

“We don’t predict any new offshore wind projects starting construction … at least in the next four years,” Sholler told Canary Media two days before Congress passed the bill.

He described Republicans’ tightening of the tax credit — from an original deadline to start construction by 2033 or potentially later, to this one-year sprint — as the final nail in the coffin for offshore wind farms that are fully approved but not currently underway. Two projects — MarWin near Maryland and New England Wind off the Massachusetts coastline — float in this gray zone, and are now vulnerable to being put on ice indefinitely.

Wind developers have faced mounting hurdles in recent months: new tariffs, a federal permitting pause, higher investment risk, and the looming threat of the Trump administration halting already-approved projects, like it did in a shocking monthlong pause on New York’s Empire Wind.

A BloombergNEF report released in April states that losing the Inflation Reduction Act tax credits, known as 45Y and 48E, would be “devastating” for U.S. projects already in the pipeline. Analysts estimate that the electricity produced by offshore wind farms that qualify for the credits costs on average 24% less over a project’s lifetime.

That April report predicted “all but the most advanced projects [will] pause development activities.” Now, with tax credits officially rolled back, prospects for offshore wind appear even more dim.

“If you take away the tax credits, it doesn’t make much sense to develop an entirely new sector,” said Elizabeth Wilson, a professor of environmental studies at Dartmouth College who studies offshore wind policy.

America’s offshore wind sector is still in its infancy. While the U.K. has already built over 50 wind farms in its waters, America has only completed one large-scale project: South Fork Wind, located off the coast of Long Island, New York.

Trump issued an executive order on Inauguration Day that froze all offshore wind permitting and leasing pending a federal review. Seemingly safe from the president’s ire at the time were eight projects, including MarWin, that already had all their federal permits in hand. Since then, at least one of those permitted projects — the 2.8-gigawatt Atlantic Shores project off the New Jersey coast — has fallen apart. Five are currently under construction.

The largest offshore wind project now being built in America — Dominion Energy’s 2.6-gigawatt Virginia project — appears unscathed by the Inflation Reduction Act rollback.

“There is no impact to Coastal Virginia Offshore Wind. The project is nearly 60 percent complete and is on schedule to be completed in late 2026,” wrote Jeremy Slayton, a spokesperson for Dominion Energy, in an email to Canary Media, dispelling concerns that the 176-turbine project off the Virginia coastline would suffer from the scaleback of tax credit eligibility.

The existing tax credits Dominion expects to secure “will result in substantial savings for our customers,” he added.

Dominion has so far spent approximately $6 billion on this monumental project. Some in the industry feared that the impact of Trump’s reconciliation bill could have been far worse, and are celebrating that the five wind farms under construction might see full operation.

“While this fight is over, I’m incredibly proud of Oceantic’s members and staff,” said Liz Burdock, president and CEO of the offshore wind industry group, in a July 3 statement after Congress passed the bill. “Because of their relentless push, developers now have one year to start construction and retain 100% of their tax credits, with a simple ‘safe harbor’ option.” (On Monday, Trump issued an executive order that tries to further limit the bill’s “safe harbor” and “beginning of construction” options.)

But for Maryland and Delaware state lawmakers who backed MarWin in the face of considerable county-level pushback in recent months, the “Big, Beautiful Bill” is a major blow. The project’s turbines were slated for installation off Maryland’s coastline but its cables would come ashore in Delaware, making it a much-anticipated joint investment.

On June 30, Delaware’s Democratic lawmakers passed a bill that strips Sussex County officials of their ability to revoke local permits for certain aspects of the wind project. A county-level block on an onshore substation was MarWin’s final hurdle and clearing it meant construction on the substation could, in theory, begin as early as February of next year.

“This bill helps eliminate unlawful and unnecessary hurdles to a project that will help ensure electric reliability for Delawareans while lowering the price they pay for electricity,” Nancy Sopko, a spokesperson for MarWin developer US Wind, told Canary Media via email.

But whether US Wind can lock in financing and officially break ground by July 2026 — the new deadline for tax credit eligibility — is another story. US Wind is suing the Sussex County Council over the permit denial in hopes of starting earlier, before the new state law goes into effect.

Before signing the final bill, Delaware’s Gov. Matt Meyer (D) said it is important to get the offshore wind energy project “done quickly and safely to provide sustainable power to Delaware.” Within days, however, MarWin had potentially been rendered incapable — at least in the view of analysts — of taking advantage of the tax credits that would make its construction financially possible.